What is CFD trading? Definition & Meaning

The ability to trade CFDs has been a major change for investors and traders in the financial markets. These types of financial derivatives have grown in popularity due to their special features, which significantly differ from traditional stock trading. If you are interested in a CFD account and are already considering setting up a trading account, we can assist in this regard.

In this article, we’ll explain how to trade CFDs and provide you with CFD trading examples to gain an even deeper understanding of this popular trading method.

CFD explanation - What does CFD stand for?

Here at nextmarkets, our customers are well-equipped to start CFD trading. However, to understand the various strategies and possibilities and select the most appropriate one, it’s important to obtain a deeper knowledge of what a CFD is.

For this, it is important to know what the abbreviation CFD stands for. What is trading without its many English abbreviations? CFD stands for Contracts for Difference. This term conveniently includes a major explanation in the name itself, however, we will elaborate further throughout this article.

What are CFDs?

The term Contracts for Difference already explains to the investor in the name that the essence of the product relies on the difference in the instrument. This is a contract or an agreement and investors seek to exploit the difference for a profit. Of course, you will need to know what this agreement is about. A CFD is a financial derivative which means that you, as an investor, can bet on or benefit from price fluctuations.

The basis for this is the changes in the prices of the underlying instruments to which the respective CFDs refer. This may be the price of a particular stock, as well as the stock value of commodities or entire indices. The trading of CFDs on precious metals, interest rates, futures, or currencies is also possible for investors.

Thus, the trading of CFDs is in no way the classic trading on the stock market. For traders, further information on stocks is available via our nextmarkets guides, such as What are Stocks? and Stocks and Shares for Beginners.

Difference to traditional trading according to nextmarkets

For beginners, the terminology thrown around on the stock exchange floor may all seem like the same thing. However, as their trading experience increases, they will note the difference in trading methods between traditional stock trading, foreign exchange, and CFDs. Once traders become familiar with the various trading vehicles, they can easily answer the questions: What are foreign currencies?, What is Forex?, and What are CFDs?

The most important difference is the position of the buyer. If you trade CFDs, such as a share on nextmarkets, you will not be buying shares in a company. This would, of course, happen in the case of a share purchase on the stock exchange.

But CFDs are so-called OTC (over the counter) products. This means CFDs, unlike commodities, stocks, etc., are not traded on the stock exchange. You will be in direct contact with a CFD broker. The contract, therefore, exists between the trader and the CFD broker. This could also be a bank, for example, or a platform that offers these services.

What you should keep in mind when trading

Our CFD definition should give you a good basis to go further into the meaning of CFDs. One of the most important things to keep in mind while learning the process of CFDs, is that their critical value is always the difference in price between the entry and exit of the contract. Similar to buying and selling a stock, except that you use leverage with CFDs.

This multiplies the price fluctuations by its value – positive and negative. This difference between entry and exit is referred to internationally as the spread and determines profit or loss.

Often, this spread is also the leeway that a CFD broker can afford to earn money as it sets the terms of the CFD offer. Trading with leverage is covered further on in this article.

Fact Check

The world of finance is also a world of abbreviations and terms. Not only do CFDs (Contracts for Difference) require an explanation. You will also encounter other terms in this environment that should be known as you enter trading.

- OTC trading: Trading products and derivatives over the counter, off the exchange

- Long-CFD: Participating in rising prices of a base value

- Short-CFD: Participating in falling prices of a base value

What is CFD trading?

Becoming a CFD trader with nextmarkets is easier than most people imagine. It does, however, require specialized knowledge. In order for our traders to do well, we provide them with this knowledge.

While we have already answered the question “what is a spread?“, we have yet to define commodities until you have decided which CFDs you would like to trade. Before that, however, we want to clarify how easy it is to trade with CFD in general and how you can successfully trade CFD online with us at nextmarkets.

CFDs, in particular, are an opportunity to move the stock market with less capital. CFD trading, as already mentioned, does not take place directly on the stock exchange, but “over the counter“.

A CFD trading example on nextmarkets

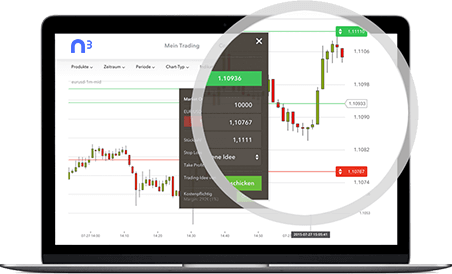

Before you can plan the right CFD strategies or even try out CFDs on the nextmarkets free trading software, you need to acquire the basic skills of trading. The most important tool here is the leverage. So what is CFD trading and how does CFD trading work?

Here is an illustrative CFD trading example: You decide to open a CFD that relates to one X share. In your case, it is a long position, so you only benefit from rising values (as opposed to the short position). For this, you deposit a so-called margin as collateral, which determines the leverage.

In our example, the margin is 10% and thus ensures that you can enter into a long trade with a value of £1,000 with only £100. If you have chosen correctly and the price rises from £1,000 points to £1,010 points, you gain £100 euros when closing the CFD.

Start trading with CFD trading simulation on nextmarkets

CFD trading, as you can see, offers a lot of potential for profit. Of course, the trade can also move in the opposite direction, so that if your trade expectation is incorrect then you can lose money. Therefore, practising and learning in advance is an important prerequisite of trading.

If you want to learn CFD trading, you should use a CFD trading simulation and the nextmarkets CFD demo trading account. This allows the trading of CFDs online without using the trader’s own capital. After all, these are highly speculative trades.

That’s why it takes some experience or a good mentor to succeed in the long run and make the right trading decisions.

What role does CFD trading play in risk?

Regardless of whether you’re targeting stocks or looking at other products with your CFD, you’ll never be completely risk-free. Likewise, with the direct purchase of a stock, companies can go bankrupt and you, as an investor, can lose your invested capital. What are CFD Stocks? Find out in our detailed guide for beginners.

The leverage in CFDs, however, ensures that this process can theoretically happen faster. On the other hand, it also allows you to make money quickly. With great opportunities also comes greater risk. In this case, possible large profits mean that equally large losses are possible.

A possible CFD trading risk also exists where some traders are unprepared for market shifts. For instance, this can happen when they purely want to make a profit on the best CFD trading app. Therefore the mantra: When is CFD trading at the lowest possible risk? With a well-prepared trader. Register now at nextmarkets!

Popularity is rising steadily

For decades, trading on the stock market has been an elitist affair. Few people could actually call themselves traders and fewer could call themselves successful traders.

The reason was, among other things, the absence of the internet and also various hurdles, which prevented easy and cost-effective entry into the financial world. Online trading and CFD trading have become more readily available over the past years.

Rightly so, because they offer investors options that traditional financial products do not offer. The benefits and disadvantages of the CFDs are outlined below and are also available on the nextmarkets online broker platform.

Significant benefits for investors

The main selling point for contracts for difference is certainly that you, as an investor, can make a profit even with the smallest amounts on your nextmarkets trades. That would not be possible without CFDs on some stocks. For example, you could buy a CFD on a single stock, which in some cases would not be possible on the stock market itself. In addition, the leverage ensures that a small amount of money can generate significantly higher profits than you would expect when buying a stock or something similar.

Another advantage is the time aspect of CFDs. They are not tied to specific terms and can be closed spontaneously using CFD software. As the volatility increases, the potential winners will be quicker to large sums of money. Accordingly, CFDs do not have to be kept for years to generate a profit.

Where there are advantages, there are disadvantages

As already indicated, chances are only possible with certain risks. Are there CFDs completely without risk? At least no legitimate CFDs.

Share prices can move both upward or downward. Anyone who chooses a long position can win a lot. But you can also lose the same amount when the price falls. When in doubt, it’s wise not to employ all your capital to a single trade as its returns are not guaranteed. That’s why CFDs are more of a financial derivative for experienced traders on nextmarkets. Without preparation and background knowledge, CFDs are more akin to sports betting than informed decisions in the financial market.

Did you know?

If you’ve done extensive research and find yourself well-versed in CFDs, this is a good time to start trying out the mobile app to learn more. The nextmarkets trading app is a good place to check out your trades.

- Available on iOS and Android

- Always up to date with push notifications

- Starting from £500 real money account

- Protection of deposits of up to £100,000 via the Financial Services Compensation Scheme

Register now with nextmarkets!

What is the risk of additional margin calls?

Short answer: no longer. For a long time, one of the biggest risks in CFD trading was the so-called additional margin call requirement. Those who found fantastic opportunities for large profits in their CFD trading before May 2017 often had to take on the risk of a large margin call if their account is negative. It meant that even if the leverage pushed the loss amount above the invested amount, an investor would have to raise money for the resulting margin call.

The good news is that this practice is now prohibited by European law. Thus, one of the biggest financial risks in CFD trading is no longer to be feared. You will not even find this in a CFD trading simulation.

What have CFDs become since abolishing this practice? At least a little less risky, because you can only lose what you have invested, but nothing more than that which is good news for those who open a nextmarkets trading account.

For which investors are CFDs beneficial?

It takes a lot of experience in the finance industry to be serious and knowledgeable about CFDs. Just knowing “What are CFDs?” is often not enough. At least not to be successful in the long term. Therefore, you should be experienced as an investor or learn from an experienced coach.

A contract for difference is especially interesting as an investment if you are the type to experience the thrill of trading and take risks as part of the investment portfolio. Often CFDs are fast trades. For example, the development of the crypto-currency Bitcoin has opened up the door to an additional type of CFD.

You should, therefore, be a nextmarkets trader who always keeps a cool head. For the classic long-term trader, there are certainly other options that could fit better.

Get the experience you need

We have now clarified what CFDs are. However, you should not wind down your first contracts right now, because there is a safe way to make the start in the CFD trading as beneficial as possible. Fortunately, you are already on the right page for it.

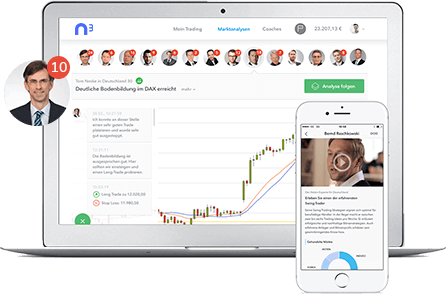

At nextmarkets, we offer you Curated Trading. This means that we can provide you with 14 trading coaches who have a great deal of experience in the field of CFDs and can introduce you to the market accordingly.

If you want, you can simply copy the CFD decisions of our coaches and you should enjoy CFD trading fast. This minimizes your risk of making mistakes right from the start and learning to trade successfully on your own.

Test your skill in our trial account

In order to minimize the CFD trading risk even further, it is a good idea to practice trades before trading with real funds. The best way is of course in a demo account. At nextmarkets, we not only provide you with experienced coaches, but also offer you the opportunity to open a demo account. The broker demo account can be used for free and indefinitely with nextmarkets.

Not only can you put your own skills to the test, but you can also test how to trade with the analysis of our professionals. Thus, you quickly learn from a professional yourself and go deeper into CFD trading.

Conclusion: Be sure to gain experience with your first CFD at nextmarkets

For a platform to be the best CFD broker, it not only has to offer products but also provide sufficient and honest information. If you are interested in testing these financial derivatives yourself and possibly including them into your financial portfolio, then rely on our system of curated trading. Open a demo account and become an expert in the field of CFDs. There are various markets and options available, regardless of whether you prefer to invest in commodities, equities, or indices.

- What are Stock CFDs? | Share CFDs Explained | nextmarkets

- What is Forex? | Definition & Meaning | nextmarkets

- What are Forex Signals

- Forex Economic Calendar

- Forex Trading Hours UK

- What are Forex Indicators

- What is Day Trading?

- What is Social Trading?

- What is Online Trading?

- What are Shares?

- What are Stocks?

- Economic Indicators