What are CFDs? - CFD stock meaning

So how do CFDs work? A Contract for Difference (CFD) is a mutual agreement between two parties to make an exchange of the difference between the opening and closing stock sell price of a contract. You can enjoy trading CFDs on a diverse range of more than 4,000 global markets on the stock exchange. Bear in mind that CFDs are complex instruments and by carrying out a CFDs trade there is a real risk of losing money.

CFDs work a little differently. CFD stock trading allows you to speculate on the movement of prices rather than the underlying assets across multiple financial markets including shares, forex pairs, indices, commodities, currencies and bonds on the stock market. Whether prices are rising or falling, you can profit with some wise investment in CFD trading. CFD trading is slowly making inroads into a wealth strategy by providing and additional investment type for those who wish to diversify their portfolios. With nextmarkets, traders have the opportunity to trade CFDs effortlessly without having to own the underlying asset. Just remember that many retail investor accounts lose money on CFDs.

CFD vs stock: fundamental differences explained by nextmarkets - What are share CFDs?

Trading stocks and CFDs are simple to do with nextmarkets. When you buy stocks, you choose your market and purchase assets at the given stock price. This means that you trade shares hoping to profit from the stock increasing in value on the stock market. After all, a stock price typically rises. Conversely, if you get it wrong, it’s where retail investor accounts lose money. CFD markets list two prices: the first is the sell price (known as the bid) and the second is the buy price (known as the offer). The difference between the two prices is called the ‘spread’ and is similar to the spread bets that are common in sports betting. Your CFD price is based on the underlying instrument price.

If you think the price of your chosen CFD contracts will increase in value on the stock exchange, you select ‘Buy’ (going long on the underlying stocks). If you believe the market of a particular stock will decrease in value, you click ‘Sell’ (going short). The core difference between CFDs and stocks, therefore, is that with CFDs you can make a CFD profit when stocks go down in value. Obviously there is the risk of losing money if you make the wrong choices on the stock exchange. If you want more detailed info on stocks, visit our “What are Stocks?” guide for beginners.

Fact Check

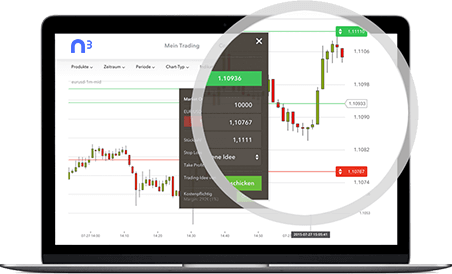

With the nextmarkets trading platform you’ll feel like you have your very own CFD broker, ready to help you trade shares at a moment’s notice. Upon joining, you’ll get access to all of the retail CFD accounts we have to offer, including:

- A demo platform with £10,000 of virtual funds to experiment with while avoiding high risk

- Competitive spreads and low margins

- Up to 200 bespoke trading tips per month and a wealth of advanced trading tools

Why investors like CFD trading through nextmarkets

CFDs are complex instruments that contain a risk for you to lose money when trading. However, they are a very popular way investors choose to actively trade shares in the financial markets. The reasons for this include:

- CFDs are tax efficient, since they don’t require you to pay UK Stamp Duty or capital gains tax on your profits.

- The flexibility of CFD trading enables you to trade on both rising markets (going long) and falling markets (going short). As such, they can be like spread bets.

- You can control a large value position with a much smaller cash investment. This is due to the larger trading volume in a standard stock CFD.

- They work as a hedging option, whereby you can offset any potential losses from your physical investments by going short.

CFD trading: a margined product

CFD trading is what’s known as a ‘margined product‘. This means that you enter a trade by paying out just a fraction of a contract’s total value. Bear in mind that with leveraged trading there is always the potential for your losses to be greater than your deposits as a result of your market exposure.

Simply put, this means you can invest a small amount of money in order to control a significantly larger amount, which can result in a hugely magnified return on investment. But you must always remember that any losses you incur will be equally magnified, so it is important to manage the high risk investment accordingly. Sign up for the nextmarkets demo account to practice strategies before using your own funds.

Who are CFDs for?

CFDs are complex instruments, but they are used by many kinds of investor. The ideal use of CFD trading is for investors who are looking for an opportunity to try and get even better returns on their money. But the significant levels of high risk to your money are not to be ignored, so CFD trading is not suitable for all people.

A good way to see how compatible CFD trading is with you would be to try trading on a nextmarkets demo CFD account before actually putting your own money into the equation. This is the ideal investment type for those who wish to play both sides of the market, whether faced with a bull or bear market. Just remember that there is always the possibility of losing money rapidly due to these high risk assets.

Common CFD trader archetypes

The following types of people are most likely to get something out of CFD trading:

- People who want to have control over what they invest in – nextmarkets offers an execution only service, so we won’t trade on your behalf with CFDs.

- People seeking short-term investment opportunities – CFDs typically remain open for a matter of days or weeks rather than for the longer term.

- People aiming to diversify their portfolio – with over 4,000 global markets to trade including FX, shares, commodities and indices, it’s safe to say your portfolio will become more diverse.

- People who want autonomy over how passive or active they are – with CFD, retail clients can trade as little or as often as you choose.

Profit with falling CFDs

If you predict that a market is going to decrease in value, you can sell a market (a move known as ‘going short’) and potentially earn a profit from the falling prices. This is where the CFD trade differs from conventional share dealing, where you can only buy (a move known as ‘going long’).

For traders, this is often the buy-in in terms of CFDs, as it gives them the opportunity to make a profit even in tumultuous times. The trick is in understanding and reading the markets to know which trades to make and at what time, as these are time sensitive. Traders can get plenty of practice from their nextmarkets demo account so that they can manage the real risk of losing money.

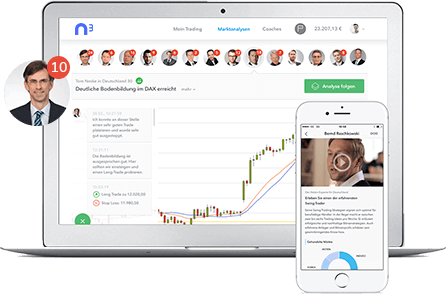

How nextmarkets support CFD traders

At nextmarkets we aim to deliver the best CFD app, so we offer a wide range of resources and retail investor accounts to build your skills and assist with risk management, ensuring you can manage your CFD portfolio without having to constantly monitor open trades. These resources include:

- Training and education to help strengthen your knowledge of CFD trading and make you a more confident trader.

- Real-time market analysis that covers major events that could impact markets in the UK, US and EU, helping you plan accordingly.

- Tools for managing risk when trading CFDs, such as stop loss orders which stop you losing money rapidly.

Did you know

At nextmarkets, we are committed to ensuring your long term success as a trader. We put the following measures in place for your peace of mind, including:

- Being backed by global investors Founders Fund, Peter Thiel, Falk Strascheg and FinLab

- Funds up to £100,000 are insured by the Financial Services Compensation Scheme

- You can start trading with just £500

Register for free and get started today.

Risks of CFD vs stock

Any market can make rapid moves in either direction at the most unexpected of moments which means that there is always the possibility of losing money rapidly. This means that there is always the risk that investor accounts lose money. It can only take a political upheaval, a major earnings announcement or a natural disaster to profoundly impact FX (s. Forex trading strategies), bonds, equities and commodities. This market volatility can present unique and exciting trading opportunities, but it can also pose substantial risks. The nextmarkets trading platform allows traders to share in the excitement of all of these movements.

And if your CFD stock trading doesn’t go your way, it can be significantly more damaging than if a conventional stock investment doesn’t pan out. Experienced traders understand the importance of comprehending risk and finding effective tools to manage it – this is an essential component of a successful trading strategy as all investor accounts lose money sooner or later. When risk management tools are used properly, potential losses are limited without restricting potential earnings. It will also help to know what is CFD.

The CFD stock 'insurance policy'

One of the most popular ways to use CFDs among investors is as a tool to ‘insure’ against losses made in physical investment portfolios. The option to short sell CFDs to profit from falling market prices makes them a great tool to offset losses made. For example, if your retail investor accounts hold £5,000 of shares in Barclays, and you become concerned that a sell-off is becoming imminent, you can put in a measure to protect your shares by short selling £5,000 of CFDs in Barclays.

This would mean that if the share prices of Barclays were to fall by 5% in the market, the loss you would take in the value of your shares would be cancelled out by gains made from your short sell CFD trade. By doing this, you protect yourself without having to go through the inconvenience and expense of liquidating your stock holdings. nextmarkets traders have access to these types of strategies through their CFD accounts and they can be a great help in avoiding losing money rapidly. Just remember that most investor accounts lose money, so be prepared for this eventuality.

Risk management strategies

Before placing a CFD trade, you should give some thought to your risk management strategy. A stop loss is a protective measure to close your position out at a predetermined price if the market moves too far against you, and it is a key risk management technique. This way your losses will be minimised, but they won’t be completely erased.

A limit order instructs a platform to close a trade at a price that is superior to the current market level, and helps lock in profit targets as part of a wider strategy. You can freely place standard stop losses and limit orders when you place a trade, or once a trade is open. And at nextmarkets we will always provide customers with the most successful trading tips and strategies so that you can avoid losing money rapidly.

Getting started with nextmarkets

There is tremendous potential in the world of CFD trading as long as you remember that many investor accounts lose money. If you wish to start trading CFDs, you need to first open your nextmarkets account with us to access the best free CFD software. We have a simple and secure application process meaning that you can start on your retail investor accounts any time. Once your application has been processed and verified, we’ll send your account details to confirm you are free to start trading.

Once you have your login details, you will be able to access our platform and have full use of all our powerful tools and resources to start trading stock CFDs. We are committed to supporting our clients’ journey to becoming successful traders, and as such we provide an extensive collection of educational material to help train you in fulfilling your potential as an investor. So sign up and see how easy it is to trade CFDs.