What is day trading? Definition & Meaning - nextmarkets Glossary

Day trading is a form of short-term trading, where traders buy and sell stocks and shares online, closing all deals within a single day. Prices usually only fluctuate very slightly within this time frame, and so day traders look to capitalise on very small movements in the market price.

Though it is perhaps one of the most controversial practices in financial trading, day trading is perfectly legal. This article aims to give an introduction to day trading for anyone thinking about trading in this way on the nextmarkets platform.

What is day trading?

Day trading is a lucrative yet at times controversial practice, favoured by a small portion of financial traders. Day traders operate in all financial markets, trading stocks, shares, commodities and foreign currencies, although the practice is most common in the Forex market and the stock market. You can find out more in our Best shares to buy guide.

The basic principle involves moving large amounts of money backwards and forwards through the buying and selling of financial instruments throughout the course of a single trading day on the nextmarkets platform. The price fluctuations during the day are only very small, so large amounts of capital are required to make any real money from day trading. It, therefore, incurs more risk than other types of trading as there is always a large amount of money at stake.

What is the day trading definition?

To count as day trading, the trader must be specifically seeking to buy and sell financial instruments in the same trading day. Strictly speaking, trading activities can only be considered as day trading if all positions are fully closed before trading ends for the day. The trader must both enter and exit the market on nextmarkets within a trading day, otherwise, the activity will be considered short-term trading instead of day trading.

Day trading is sometimes the only trading strategy that traders will be using. There are financial speculators who exclusively trade stocks in this way; however, others will use day trading as part of a wider trading strategy. Still asking yourself what are stocks? Read our introductory article as a refresher.

How does day trading work on nextmarkets?

Most markets will not move much within the space of a day, but the price will fluctuate small amounts. Some markets are more suited to day trading as there are markets which are more liquid than others. In markets with high liquidity, stocks, shares or assets can be purchased and sold quickly and easily. This means that day traders are able to buy and sell their assets almost instantly.

This is key to a day trading strategy. If the market is not liquid enough, traders will not be able to move their assets quickly enough to capitalise on small movements in the market price. You can get started in day trading by using a broker such as nextmarkets where you can test your skills with our free nextmarkets broker demo account.

Day trading basics: is it illegal?

Despite much speculation and frequent rumours among amateur traders, day trading is not illegal. It is, however, a risky business. The profitability of the practice of day trading is one of the most debated topics among traders. Over the last decade, there have been countless scams online, creating confusion by overpromising on the possible returns within impossibly short amounts of time – promoting day trading as the latest “get rich quick” scheme.

The rumours of illegality probably stem from these scams and a misconception that the practice of day trading in some way damages market prices. If you want to get into day trading, make sure you choose the nextmarkets free trading software that offers analyses and tutorials, as well as provides assurances on the security of your deposits.

Fact Check

“What is day trading” is a simple question with a multitude of answers. Be sure to get your facts straight:

- Despite rumours to the contrary, day trading is perfectly legal

- No evidence suggests that day trading is detrimental to the markets

- Day traders are some of the biggest risk-takers in the financial industry

Risk vs reward with day trading on nextmarkets

Just because day trading is not illegal does not mean that it is recommended for those new to the markets and a nextmarkets demo account is recommended just to learn the ropes. It is not an unethical practice, but it is a highly risky trading strategy which requires huge amounts of capital. When they first get started, day traders typically lose very large amounts of money over the course of their first months in the game.

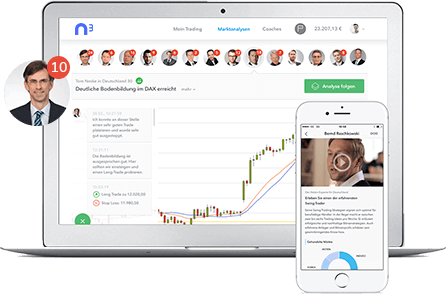

It is vital that anyone adopting a day trading strategy can afford to lose the money they invest. Due to this and the quick pace of the day trading game, it is not for the faint-hearted! At nextmarkets, you’ll find lots of analyses and top tips from our professionals, and if you’re new to the markets, you can watch their trades to learn how to master it for yourself.

How to minimise day trading losses

One of the key ways in which day traders try to minimise their losses and maximise their profits is to use free day trading software. There are a number of different indicators which day trading software will track.

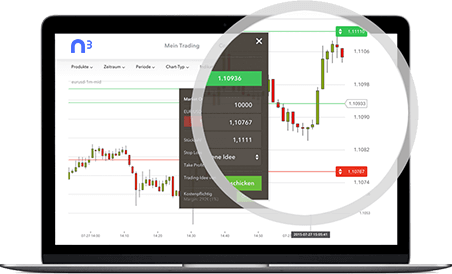

Automatic pattern recognition will look for flags, channels and other market signals and alert traders to opportune moments to trade. Traders can also consult the nextmarkets best day trading app or trading platform for backtesting results. These results tell you what would have happened if you had used a certain strategy in the past, giving you an idea of how you might choose to trade in the future.

Day trading glossary for beginners on nextmarkets

There are several key terms which are integral to learning about day trading strategies on the nextmarkets platform. Some of the most important ones to understand are:

- Arbitrage – buying and selling financial instruments simultaneously to make the most of different market prices for the same financial asset.

- Leverage – using money borrowed against invested capital (usually from a broker) in order to increase the amount of money which is invested and therefore the potential return on investment.

- Liquidity – the ease of buying or selling assets quickly in a given market, without the price being affected. A high liquidity market is one in which financial instruments can be purchased or sold almost instantly at stable prices.

Day trading: meaning of strategies

Trend following – a strategy used across long and short-term trading on nextmarkets, assuming that the market will continue heading in the same direction if it has been moving steadily in that direction for a while.

- Contrarian investing – the opposite of trend following. This strategy assumes that a rising market will start to fall and that a falling market will start to rise.

- Range trading – this strategy assumes that the market will always stay within its usual range. As soon as a price hits its support or resistance line on the market, it is expected that the market will turn around.

- Scalping – this is a popular strategy among day traders as it involves exploiting the gaps in prices which are created by the difference between a market’s buy and sell price. These usually have to be exploited in a matter of minutes or seconds. You can learn more about this in our Scalping Trading Strategy guide.

Day trading and market data on nextmarkets

Market data is vitally important for all trading strategies, including those traded on the nextmarkets platform, but for most long-term strategies there is no need for this data to be up-to-the-minute. Due to the nature of what is day trading, there is a crucial need for live market data. Delays of up to an hour, as are standard in processing market data, would cause day traders to be acting on information which is well out of date.

In day trading, speculators must make decisions based on the market’s movements in the last few minutes or even seconds. This means that day traders really need access to a real-time market data feed. There are sometimes additional fees charged for granting this real-time access.

Day trading terminology used by traders on nextmarkets

The majority of day trading terminology used by traders is no different than that used in other trading strategies. Many of the same actions take place as with longer forms of trading on nextmarkets, but they simply take place within a condensed time period. If you have experience trading in other ways, chances are that you will recognise a lot of the words and phrases used.

If you are new to speculating and are looking to learn day trading for beginners, then it is worth having a glance over a day trading glossary before you get started. It is also recommended that you look up any words or phrases which are unfamiliar so that you are certain you have correctly understood the meaning. Otherwise, you could make mistakes in an already risky practice.

What do you need to start day trading?

The first thing that you need become a day trader is access to a market through a nextmarkets broker account. Secondly, you’ll need money to invest. With day trading, the only way to make big rewards is by investing big. The more money you stand to win or lose, so you will also need confidence in your ability.

Day trading involves even more risk than other types of trading strategies as activity has to take place so quickly. Even the best day trader can stand to lose money, so day traders need to be careful not to invest any more money than they can afford to lose in any given day. For the best CFD and Forex broker UK-wide, choose nextmarkets.

Did you know?

Day trading is not an exact science, but there are guidelines you can follow to make sure that you don’t fall too far if the market does not move in your favour when trading on nextmarkets:

- Do not trade with more money than you can afford to spend

- Use your broker’s leverage to maximise the amount you can trade with to boost your returns

Day trading defined several ways

There are many different ways in which day trading is defined throughout the financial industry. That’s because many traders cannot agree on a single day trading definition. Some people will define day trading as the practice of not looking beyond the current trading day to look for their indicators as to when to enter or exit a trade.

Some people use it to refer to trades that coincidentally took place on the same day. Beware of these misused definitions when exploring tips, strategies and indicators for day trading. The real definition of day trading is simply exiting each day with all positions closed, and only cash in your nextmarkets account balance.

Introduction to the day trading desk

What is the day trading desk? The trading, or dealing, desk is a key resource for traders dealing with large amounts of money and purchasing and selling large numbers of assets. The trading desk can be even more crucial for day traders than for traders adopted other strategies in the market. The desk gives these speculators the ability to execute their orders instantaneously and is used in conjunction with the nextmarkets platform.

This is vital for successful day trading, as seconds can make all of the difference if there are sharp movements in the market price for a certain financial instrument. Day traders who can get in their orders before the rest of the market begins to move are the ones who will have the biggest advantage.

What constitutes the day trade meaning?

A day trade is an exchange which is entered and exited within the same trading day on the nextmarkets platform. This means that the trader will start the day with cash and end the day with cash, having exchanged that cash for a financial instrument and back again at least one.

Day trades can happen outside of the practice of day trading, and the people who make them are not necessarily known as day traders. So what is day trading? It is where a single trader almost exclusively deals in day trades, starting and ending most trading days with cash. It is a pattern of trading behaviour and a recurrent strategy for dealing in a financial market.

Day trader defined: who can become a day trader?

Although technically anyone can make trades within in a day as long as they have access to the market and a nextmarkets day trading account, it takes a particular set of characteristics to make a successful day trader. Successful day traders will have experience and knowledge of their chosen market. They will have a deep understanding of what “normal” looks like for that market and the best indicators to look out for.

Day traders also need to have deep pockets, and restraint. They need to have a reasonable amount of money, but to also know to only invest money that they can afford to lose. Lastly, but by no means least, day traders need a strategy to try and beat the market. For all of these reasons, day trading is an approach more suited to professionals than amateur traders.

What are pattern day traders?

Anyone asking the question “what is day trading?” will sooner or later be struck with another question: “what is a pattern day trader?”. The US FIRA (Financial Industry Regulatory Authority) introduced a rule to financial trading which restricts who can become a day trader.

The rule says that anyone who buys and sells the same financial instrument in the same day more than three times in a business week (i.e. who completes four or more day trades in a week) must have at least $25,000 of equity in their margin account. This stops traders with less money from becoming prolific day traders. For their protection, many UK brokers require the same. Pattern day trading can take place on the nextmarkets platform.

Get started day trading today with nextmarkets!

If you are already experienced in the markets and are thinking about stepping up your game, then you might be considering getting started with day trading. nextmarkets provides potential day traders with everything they need to begin their day trading adventure.

Just download our app to your iPhone or Android device, or use our web app via your browser to gain access to the markets, all the latest market data and software and apps to help with reading the market for signs and indicators. While we cannot provide the confidence and capital, all of which are vital characteristics of a successful day trader, we can equip you with insights and support from the pros to give you the best chance for success. Download your free nextmarkets demo account today and learn the ropes of trading shares, with £10,000 of virtual currency.

- What is Swing Trading?

- Economic Indicators

- What are Stocks?

- What are Shares?

- What is Online Trading?

- What is Social Trading?

- What are Forex Indicators

- Forex Trading Hours UK

- Forex Economic Calendar

- What are Forex Signals

- What is Forex? | Definition & Meaning | nextmarkets

- What are Stock CFDs? | Share CFDs Explained | nextmarkets