What are stocks? Definition & Meaning - nextmarkets Glossary

The phrase “stocks and shares” is often used in relation to financial trading. These are terms which are usually used together, and this is because, for all intent and purposes, stocks and shares are the same thing. If you purchase shares, you are investing in the stock market. When trading stocks and shares for beginners on nextmarkets, you can use these two terms interchangeably.

What are stock markets?

The stock market is a place where individuals, brokers and companies come together to buy, sell and exchange shares in publicly held companies. People can either invest their own personal savings as individuals or manage large portfolios of financial assets on behalf of banks, companies and other organisations.

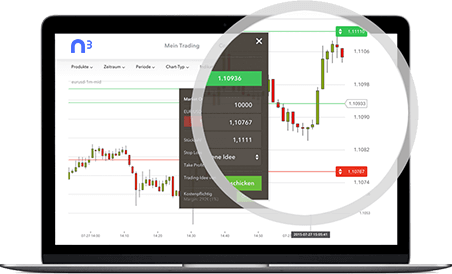

The stock market is heavily regulated, and exchanges can either take place within institutions or over-the-counter. Each country tends to have a central stock market, however, there may be several trading venues where investors can buy and sell stocks or shares. The stock market comprises a physical trading floor, but nowadays, exchanges can also take place online through the nextmarkets stock trading software.

How does the stock market work?

If a trader “owns stocks”, this means that the individual (or organisation) owns a slice of a publicly traded company. The size of the slice owned can be calculated by dividing the number of shares that the traders own by the total number of shares the company has made available to purchase.

For example, if a company has a total of 10 outstanding shares, and a trader owns 1 of these shares, they will then own a 10% stake in that company. Most publicly limited companies have a number of outstanding shares which will total in excess of one million.

What do you need to know before you start trading with nextmarkets?

There are two types of stock which are commonly traded: common and preferred. Common shares are those which also come with voting rights. This means that a common shareholder will have the right to vote in corporate meetings, and have a say about decisions made about the running of the company.

Preferred shares are ones which do not generally come with these privileges. In order to justify the right to vote, common shares tend to be much larger than preferred shares. Preferred shares are called this because they will receive preference over common shares when it comes to receiving dividends and/or assets in the event of the company going into liquidation. Traders on the stock market typically trade in preferred shares rather than common ones and traders should be made aware of this before starting their journey with nextmarkets.

Fact Check

Now you know all about stocks and how they work, here are a few surprising facts about stocks and the stock exchange that will undoubtedly shed some light on this method of trading:

- The London Stock Exchange was founded in March 1801

- The London Stock Exchange is commonly shortened to LSE and is one of the busiest exchanges in the world

- In 1960, an electronic screen called “The Enunciator” replaced paper noticeboards, marking the beginning of the digitisation of stock trading which eventually lead to online trading, affording traders a chance to open an online profile with nextmarkets

Why do companies want people to invest in stocks?

Growing a business quickly and significantly can only be done with a huge amount of capital. For example, if a manufacturing business wishes to expand in order to process and satisfy more orders, they would first need to increase both their factory capacity and their staffing numbers, as well as purchasing more raw materials.

All of these costs would have to be paid before the company saw any return on investment. This money has to come from somewhere. The most common way of raising this money is to allow investors or traders to purchase part of the company, generating capital very quickly and allowing the company to reimburse and reward investors once they see the desired growth in the business. For traders using the nextmarkets platform, the rewards phase of investing is an exciting part of the journey.

Why do stock prices move up and down?

Stock prices can fluctuate for a huge number of different reasons, but the general guiding principles remain the same, regardless of the specific nuances of a particular day. There are millions of financial traders making investments in the stock market every single day. Traders get to see these trades when they log into their nextmarkets profile.

These investors will all have different thoughts about what the value of a specific stock may be, and therefore the price which they believe the stock to be worth. The numerous transactions which take place between traders who sell and know the best shares to buy cause the overall market price to move up and down. If lots of people are trying to buy, the market price is likely to increase as people will be more willing to pay a higher price to secure their stocks.

Why do people invest in stocks?

Stocks are a common investment tool used by individuals and organisations alike. Investing money is one way of growing your existing assets. Even if you place your money in a savings account, indirectly you are likely to be investing in stocks as the bank you use will invest the money you have saved on your behalf.

The interest you receive is the payment the bank gives to you for lending them your money to invest with. Making the decision to invest your money yourself gives you more control and the possibility to reap higher rewards. Although it also carries a greater risk to your capital. Learning the ropes through the nextmarkets demo account is a good place to start.

Why are stocks called stocks?

There is no one definitive answer to why stocks are called stocks. One of the most popular theories as to why we ask the question “what are stocks?” and not “what are shares?”, is to do with the origins of trading. Some etymologists believe that the word “stocks” is a shortening of the word “livestocks” and comes from the markets where cattle, sheep and pigs (among other animals) were traditionally bought and sold.

Over many decades and centuries, trading evolved to include shares and services, not just physical commodities. However, this one etymological theory suggests that the name stocks was retained. Today, nextmarkets traders are familiar with the terms and they’re unlikely to be replaced with a more modern version.

How to buy stocks

The most common way to purchase stocks is through a nextmarkets demo account for stock trading. What are stock brokers? They are the people or organisations who provide traders with access to the markets, usually via share trading software. Brokers require traders to set up a share trading account and deposit the money with which they can purchase stocks and shares.

It is up to you to choose which type of stocks, and how many stocks you want to buy. The broker will then make this trade for you, using the money deposited in your account. As payment, the broker will earn a commission on the trade, which is usually calculated at a few pennies per share purchased.

What is the function of the stock market?

The stock exchange is not merely a place for traders to make money – it also forms an important part of a country’s economy. Allowing traders to buy and sell stocks enables individuals and organisations to increase their capital and net worth. If the net worth of individuals and companies increases, so in turn does the economy within which they operate.

Allowing shares to be purchased in the first place will mean that more companies are able to get off the ground to begin with, and contribute to the overall size of the economy. This is why the stock market is so vital, and is protected with rules, regulations and organising bodies. nextmarkets is proud of their regulatory status, which gives consumers peace of mind that their online trading profile is regulated and secure.

What are penny stocks?

Penny stocks are those which can be purchased for next to no money. Although it would be highly unusual to find shares available to buy for a penny nowadays, there are still plenty of bargains to be had. Any stocks which are priced up to $5 each can generally be referred to as penny stocks. Traders can purchase lots of these easily and at very low prices.

This is one of the best ways for individual traders to make money on the stock market, as they are often lower-risk investments and easy to purchase through an online stock broker or a stock broker app. There are certain traders whose strategies will restrict them to only buying and selling penny stocks and never purchasing shares worth more than $5 each. At nextmarkets, we pride ourselves in providing easy access to the trading market at low costs to our users.

Did you know

There is much confusion among novice traders about the difference between stocks and shares. Before you start trading, get your terminology right:

- Shares are defined as a percentage of a specific company owned by an individual or organisation.

- Stocks is the word used to more generally describe multiple shares in different companies.

- Nowadays, these two words are almost interchangeable, even among professional traders who use the nextmarkets platform. For those new to trading, the interchangeability of the terms can seem confusing.

The definition of stocks

Stocks definition: the collective noun used to describe shares across multiple different companies. By this definition of stocks, if you purchase shares in more than one company, you will be able to say that you own “stocks” rather than “shares”.

What are shares? This is a legal term used to describe the part of a company owned by an individual or organisation. An introduction to stock market UK Within the stock market, shares are bought and sold at different prices with the intention of making money for the trader through a nextmarkets account. Stocks is the term used to refer to large volumes of shares, usually from more than one different company.

An introduction to stock market UK

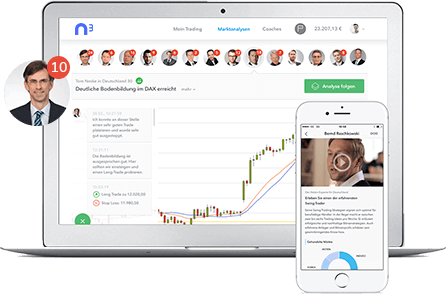

There are plenty of resources available online which give an overview and introduction to the stock market for novice traders intending to make their first investments. Reading the nextmarkets guide on how to buy shares is a great place to start.

You can also use a nextmarkets share trading software to access tutorials, tips and demo accounts – everything you need to begin your journey as a stock trader. As a novice trader, it is really worth getting a proper introduction to the stock market before you start trading, as you will need a base level of understanding to really get to know how to make the most of your trades.

The stock market: Definition & Meaning

The stock market is the name given to the collective actions of buying, selling and exchanging stocks and shares. All of the transactions taking place within a single market are collectively referred to as the “stock market”. Although it is not a physical market, each country will typically have a venue known as the stock exchange, with a trading floor where transactions can be made digitally. Online traders can access these trades through their nextmarkets account.

Just like a physical market, the stock market will also typically have opening and closing hours, so that trades can only take place when the market is open for business. Before planning to make any trades, check out the trading hours of the market you wish to have access to.

What are stock traders?

A stock trader is simply the name given to any person or organisation who invests in financial markets. These can be individuals investing their own personal wealth or professionals who trade with the assets of an organisation or institution. Stock traders use the nextmarkets platform to facilitate their trades.

There are different ways in which different types of stock traders will access and operate in the financial markets, but the name stock trader will apply to anyone who buys and sells stocks or shares. From the beginner making their first trade, to an investment banker with decades’ worth of experience in financial speculation, anyone who purchases and sells stocks has earned himself the title of “stock trader”.

nextmarkets explains: why do stock prices go up?

Stocks adhere to the principles of supply and demand, in just the same way as products, commodities and services do in all markets. If more shares of a certain company are demanded than there are able to be supplied, the price will increase on the nextmarkets platform. More people will be willing to pay more money to acquire this more scarce resource.

As the general perceived value of these stocks or shares increases, so does the market price. There are lots factors which might cause a sudden increase in the perceived value of a company’s shares, such as a change in management, the launch of a new product, a burst of publicity or a great sales performance.

Stocks 2.0 according to nextmarkets

What are stocks? They are a financial instrument, made up of shares of ownership of different companies and organisations. They can be bought and sold by traders online, over the phone, or via the nextmarkets share trading app. As the prices in the market fluctuate constantly, traders can capitalise on these changes in price, selling their stocks on again once the market price has increased and making profits on their trades.

If the trader is able to sell their shares in a company for more than they paid to purchase them, they will profit from the transaction. Do this over and over again and you can make a decent amount of money on the stock market, but it certainly isn’t as easy as it sounds!

- Economic Indicators

- What is Swing Trading?

- What are CFDs ? | What is CFD trading? | nextmarkets

- What are Stock CFDs? | Share CFDs Explained | nextmarkets

- What is Forex? | Definition & Meaning | nextmarkets

- What are Forex Signals

- Forex Economic Calendar

- Forex Trading Hours UK

- What are Forex Indicators

- What is Day Trading?

- What is Social Trading?

- What is Online Trading?