What is swing trading? Definition & Meaning - nextmarkets Glossary

If you’re new to investing, you’ll be looking to learn about different approaches to find what will be best for you. At nextmarkets we support a continuous journey of learning for all our clients, and our platform offers all you need to get off the ground.

Swing trading is one of the most popular methods of making a living from investing, but there is much to learn. Read on to learn all about swing trading, and how nextmarkets, the best forex broker UK investors could ask for, could be the ideal platform for you.

So just what is swing trading?

Swing trading is an almost fundamentalist trading style wherein positions are held beyond a single day. It sits somewhere in the middle of the continuum between day trading and trend trading. Curious about day trading? Make sure to read our what is day trading? guide for beginners.

The idea is to profit from sudden price changes or ‘swings’, so an asset is usually held between one and several days in the hopes that a significant swing will occur. Many swing traders will make use of a set of mathematically based objective rules in making their buying and selling decisions through their nextmarkets account, so to be a successful swing trader you will have to learn and develop specialist systems and strategies.

The swing trading definition vs. trend trading

The swing trader works within the boundaries of range-bound markets; they buy at a point of support and sell at a point of resistance. A trend trader, however, gambles on an uptrend or a downtrend, holding their position until the trend changes. The nextmarkets platform provides the ideal setting for both types of traders.

Swing trading works best for time frames of just a few days, while trend strategies tend to apply for longer periods up to a few months. The two techniques are different, although the lines have been blurred as real-time charting has become increasingly prominent.

Swing trading is a great style to learn as a new or intermediate trader, and the nextmarkets platform does all it can to support your education. With dedication and perseverance, you could master the technique and achieve some great success through the best forex software.

nextmarkets explains: how does swing trading work?

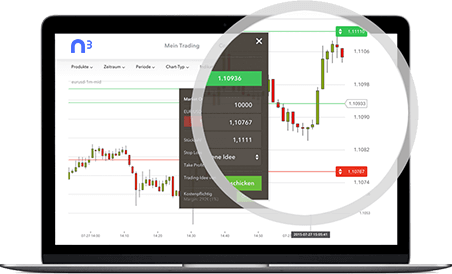

Swing trading is largely dependent on extensive and detailed technical analysis of market trends to determine whether particular stocks might make sudden swings up or down in the very near future. There are various technical indicators that need to be examined, and swing traders use them to identify stocks that show momentum in their price movements. nextmarkets provides traders with up to date information in order to help them make a decision.

This helps to signal the best times to buy or sell a position but requires technical know-how and experience to carry out effectively. Swing traders don’t concern themselves with the long-term value of stocks; their approach is all about recognising the signs of momentum and profiting from price swings. For more information on Momentum Strategies, make sure to read our detailed guides.

A few swing trading basics

The primary thing to understand about swing trading is that all stocks do actually move up and down in patterns that can be predicted. And each pattern consists of stages, waves and visible trends. We can identify these things more easily through the use of moving averages, and stock movements go up or down to price areas in the past and reverse.

In swing trading, we call this ‘finding support‘ or ‘running into resistance‘. The reason the patterns of stocks are predictable is because they are being moved by humans, and human behaviour can be predictable if you know all the variables. So it’s important to learn the psychology behind certain movements to make effective predictions through your nextmarkets profile.

Fact Check

With nextmarkets, you will feel like you have your own personal broker and adviser right at your fingertips. There are many fantastic benefits to enjoy with a membership, including:

- Low margins and competitive spreads

- Investment suggestions formed by your trading habits

- A demo platform with £10,000

Best candidates for swing trading according to nextmarkets

Most markets spend the majority of their time going nowhere fast. The typical pattern is that they rally for a bit, decline, then rally again. Small swings are far more common than large ones, and by the end of the month a market will have gone up and down several times over. The art of swing trading is to capture profits from these small swings.

So the best swing trading candidates are the most actively traded stocks that tend to swing within broad, visible channels. The nextmarkets platform allows you to enter channel lines on price charts, so you should monitor a list of stocks each day to become familiar with their price actions. A popular choice of asset for swing trading is Forex (FX) trading. Before you get started with FX, make sure to take some notes from our What is Forex? guide.

Brokers for swing trading

One of the most important decisions of your career as a swing trader will be choosing the right broker or brokerage. It is not as essential to use an online broker for swing trading as it is for day trading, so you could consider using a traditional broker if you like.

But there are many benefits to be enjoyed from using an online broker, such as cheaper fees and commissions. The nextmarkets platform is a superb choice for swing traders, offering a powerful broker demo account and a wealth of resources to educate and train yourself to be a successful swing trader.

Understanding the definition of swing trading

For beginners, the technical terminology in swing trading can be confusing. In simple terms, it is a style in which users seek to make profits by holding an asset for between 24 hours and several weeks. In this slightly longer timeframe, you are more likely to see a greater price shift than you would see in a single day, but you must undertake more planning and analysis to minimise your risk of losses.

The technical analysis required involves understanding some more advanced concepts and terminology, so it will be a learning process that could really benefit you in the long run. With discipline and a studious approach, swing trading is a great thing to master. The nextmarkets platform is ideal for those who want to learn the ropes of swing trading.

The swing trading meaning for you

With the power of the internet, the nextmarkets platform makes swing trading strategies more accessible to the independent investor than ever before. To determine what swing trading could mean for you, it’s important to understand how compatible it is with your own style and personality. For some, it will sound exciting, while for others it may seem a little too complex and demanding.

In any case, you need to focus on the long-term sustainability of your trading strategies, and this takes consistency and discipline. Choosing to become a swing trader is a big commitment, so it’s important that you are honest about whether or not yours is the right type of personality to make that commitment.

Popular types of swing trade

One of the common favourites among swing traders is the classic breakout trade. This type of setup is identified using advanced technical analysis, taking advantage of price momentum, and it works best when the market environment is healthy.

The specific price pattern involved can come in a number of different shapes and sizes, so it is best described in the following way: A clear and direct transition from a state of mean reversion to a state of momentum or trend, signalled by an expanding range through a clear trendline or pattern. The move should be a little intimidating as it is deemed as a risky move. Traders can practice these strategies on their nextmarkets demo account.

Key swing trading terminology on nextmarkets

Support level: This is a financial term that indicates a price level which a stock has historically never fallen below. This is usually the level at which buyers will purchase a stock.

Resistance level: This is the price point at which a stock’s price rise is halted by an increase in the number of sellers choosing to sell at that price. They can be short-lived if new information emerges, or they can be long-lasting.

Range-bound markets: When stocks trade in certain price channels, which can be identified by finding significant support and resistance levels connected with horizontal trendlines, swing traders can buy a security at the lower support and sell at the upper resistance.

Swing trading: technical vs. fundamental analysis

The ultimate goal of the swing trader is to work with multi-day, or sometimes multi-week, stock. For this reason, it’s not really possible to develop a trading system that is based solely on the fundamentals. Technical analysis is the bread and butter of the swing trader, but the fundamentals can play a supporting part in the development of a strategy.

The approach will be predominantly driven by technical analysis, but knowledge and understanding of the fundamentals is definitely a good thing to have when forming your strategies and systems. At nextmarkets, we offer a range of analysis on all kinds of trading strategies so you can make the best decisions.

Did you know?

The highest priority at nextmarkets is the future success of your trading career. For this reason, we put a range of measures in place, such as:

- Investor protection of up to £100,000 covered by the Financial Services Compensation Scheme

- Backing from renowned global investors Falk Strascheg, Founders Fund, FinLab and Peter Thiel

- Initial margin as low as £500

A day's swing trading defined

A committed swing trader on nextmarkets will start early in the day, using the time before the market opens to get an overall feel for the day ahead; finding potential trades, creating a watch list and checking existing positions. Taking time to browse the latest financial news is important, looking for market sentiment, sector sentiment and updates on current holdings.

The search for potential trades should identify special opportunities and sector plays, drawing up a definitive watch list. Once the market opens, it’s all about observing and trading based on given strategies and algorithms that the swing trader will be well-practised in.

Your introduction to swing trading through nextmarkets

At nextmarkets, we offer a comprehensive demo trading platform that allows you to get a feel for different types of trading. You get to trade on an advanced simulation of the market, taking advantage of our platform’s expert advice and training resources to learn how to grow as a swing trader and get a feel for the strategies and patience the discipline requires.

Our platform provides one of the most realistic and sophisticated demo experiences to help you find your feet and learn if swing trading is a good fit for you, and it only takes a few minutes to register your forex demo trading account.

Example of the swing trade meaning

An example of a swing trade would be to identify a stock where the weekly trend is up, and the lows on the day’s bar chart are short and sharp. You would then analyse how the stock has behaved since the trend began. If it has returned to its moving average three or more times, and penetrated it by more than 1.5% of its price on average, this is the time to place a buy order.

You would then place a protective stop fairly close to your entry point, and cash out on profits near the upper channel line. The experienced trader will factor in other variables for their decision-making, but this is an example of what it means to execute a swing trade on nextmarkets.

The perfect swing trader defined

There are various traits that make someone suitable for swing trading. One should have the ability to think long term and be able to make decisions with a vast number of future trades in mind. Self awareness is important, as is having the patience to hold off on taking action on your nextmarkets account until the time is right.

You also need to be good at planning and sticking to a plan once it is made – straying from your plans is deadly in constantly evolving, noisy markets. That said, the ability to adapt is always helpful, as long as you do so in a measured and strategic way.

Practising risk management in swing trading

The key to risk management in swing trading is to have well-defined entry criteria. A good approach is to have a clear transition from a state of mean reversion to a state of momentum, or trend. This will be signalled by an expansion of range through a strategically defined trendline or pattern. If that transitional state can’t be held, and you fall back to the prior range or pattern, it’s time to move on.

So breakout trades work well with tight stop-loss parameters. In terms of setting profit targets, you should assess the size of the base pattern the stock is emerging from, and look back at the lengths of previous price swings. For a more in-depth look at strategy, check out the nextmarkets forex trading strategies that really work.

Try swing trading for free today with nextmarkets

nextmarkets is the innovative forum where you can learn and demo different trading methods before committing to a journey trading assets on a leading online investment platform. We help you learn the intricacies of swing trading and provide in-depth analysis and reports from experts to help you recognise the patterns and trends that will enable you to succeed as a swing trader.

Try the best forex trading app today by opening a demo account with £10,000 of virtual money and find out if swing trading is the right choice for you. Your trading career starts here, and nextmarkets supports you.

- Economic Indicators

- What are Stocks?

- What are Shares?

- What is Online Trading?

- What is Social Trading?

- What is Day Trading?

- What are Forex Indicators

- Forex Trading Hours UK

- Forex Economic Calendar

- What are Forex Signals

- What is Forex? | Definition & Meaning | nextmarkets

- What are Stock CFDs? | Share CFDs Explained | nextmarkets