What is trading? Definition & Meaning - nextmarkets Glossary

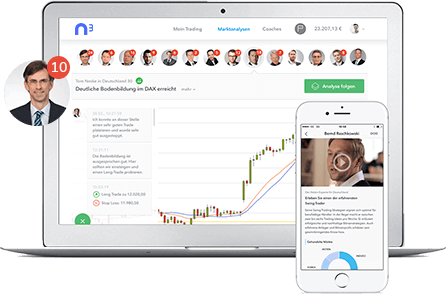

If you’re interested in investing in the financial markets, you will probably do it through an online trading broker. With the nextmarkets platform, you can enjoy the expertise of a personal broker, with the efficiency of a user-friendly trading app.

Our modern platform connects leading market analysts with new and experienced traders, allowing your accounts and trades to benefit from insights and expert coaching in real time. If you want to get started investing with the best online broker, register with nextmarkets for free now. If you want to learn more about online trading, you’ve come to the right place.

What is trading?

The concept of ‘trading’ refers to exchanging one item for another. This typically means that we exchange goods for money, and in the financial markets, the same principle applies. When you trade as an investor, you purchase assets and profit from changes in the value of those assets. This is trading in a nutshell – you buy something for one price and sell it for another, hoping to make a profit.

The value of an asset goes up when demand is high and supplies are low. But when demand is low and supplies are high, the value will decrease. When you trade in the financial markets, you must do your research to make predictions about what will happen to the assets you examine. If you want some detailed information about how to start out with nextmarkets, check out our guide, Trading for Beginners.

Origins of the trading definition

Trading dates back to the dawn of mankind. When people discovered they could get a new arrowhead in exchange for some spare flint, trading began. And before modern currencies came into existence, people would often barter to buy and sell goods; they would exchange items directly for mutual benefit.

Just like trading, bartering is based on two main factors: products that others need, and some form of negotiation between buyer and seller to reach an understanding that closes the deal. Currency came into existence as certain items emerged as common items for bartering; gold and silver coins emerged as common currency in some ancient civilisations, and gradually modern currencies came to be.

So what is online trading?

For decades, financial trading was conducted only between banks and financial institutions. This meant that no one outside of these institutions had access to the financial markets. As the internet came into existence, and as it evolved into a high-speed entity, trading became accessible to virtually anyone who wants to get involved. Virtually anything can be traded online.

Commodities, stocks, currencies, physical goods and all manner of other things are assets that can be bought and sold with nextmarkets. In essence, if something can be traded, it will be. The forex market is currently the largest, with almost $4 trillion worth of currency traded every single day. You can find out more about forex in our dedicated Forex Trading guide.

Fact Check

The nextmarkets platform gives you your very own online broker in the palm of your hand. Registering gives you access to a wealth of superb benefits, including:

- A demo account with £10,000 of virtual funds

- Competitive spreads with low margins

- Bespoke trading suggestions tailored to your trading habits

- Protection via the Financial Services Compensation Scheme of up to £100,000

Try it for yourself today, no payment necessary.

Why increasing demand drives prices upwards

This can be explained with a simple analogy of buying food. Say you are in a market and there are only ten apples left on a stall. There are no other places to buy apples. If you are the only person there looking to buy apples, the stall owner will probably offer a reasonable price.

But if there are fourteen other people there in need of apples, they will be willing to pay extra to ensure they get one. This allows the stall owner to put a higher price on the apples because he knows the high demand outweighs the supply and people will pay the higher prices. Once the price reaches a point that customers think is too expensive, they will stop buying and the price will cease to rise.

Why increasing supply drives price downwards

If there is more than one stall at the market selling apples, there is a plentiful supply of that commodity. It stands to reason that different stall owners will want to add incentive for customers to choose their stall over their competitors’, and it also stands to reason that the biggest incentive for customers will be a lower price.

This means that stall owners will lower prices in an attempt to attract customers. When the point is reached where demand matches supply, this is called the ‘market price’ – essentially, this is the point where both the stall owners and the customers agree on a price and the number of apples sold.

Creating your own definition of trading

If you aim to get involved in the financial markets, your journey will take you to form your own definition of what trading means to you. While the generic concept of ‘trading’ is constant, everyone engages with it in their own way. That is why there are so many styles of trading, assets to be traded and strategies for success.

Everyone is unique, and everyone will develop their own approach to trading. At nextmarkets, we like to provide as much support as possible for clients to form their own identity as a trader and trade in the way that is well suited to their strengths and weaknesses. From our sophisticated demo platform to the wealth of tools and resources to learn from, we are the best trading software to find your own trading definition.

Online trading meaning greater control

The traditional trader never had as much control over their trades as the online trader. Online trades can be executed far quicker than any done face-to-face or over the phone. And in addition to being able to manage multiple positions at once, the online trader has instant access to extensive real-time data.

The nextmarkets platform provides comprehensive information on exchanges, markets and companies, as well as in-depth market analysis from expert traders to help you make the right choices. We ensure you always have access to the most successful trading tips and strategies at all times. The internet has allowed people further down the socioeconomic ladder to take advantage of the power of the financial markets, but no one should take online trading lightly.

Responsible online trading with nextmarkets

As an online trader, you should only ever risk what you can afford to lose. A good rule of thumb to guard against heavy losses is to use a stop loss. This is a predetermined level of risk that you are willing to accept in a trade, and can be specified as a percentage or a certain amount of money. Whichever way you specify it, it limits your expenditure during a trade. Failing to implement a stop loss is bad practice, and you should factor in stop losses to your strategies to ensure even a losing trade falls within your trading plan rules.

Some key trading terminology

There are hundreds of terms and expressions you will come across on your journey as an investor, and you will learn as you go. But here are a few of the key terms that are relevant to most forms of online trading:

- Spread – the difference between the ask price and the bid price; the spread is designed to provide compensation to market makers.

- Bid – the price an investor would receive if selling a security.

- Ask – also known as the offer, this is the price an investor pays when purchasing a security.

- Market maker – works within the over-the-counter market, market makers are always poised to buy/sell shares of assigned securities for their own accounts.

Online trading like a boss

If you want to get the most out of online trading, you must treat it like a business. If you trade as a hobby, with no real commitment to learning, you will probably find it to be a very expensive pastime. Trading is a business, subject to expenses, losses, uncertainty, taxes and stress.

As an online trader you are a small business owner, and it’s important that you do all you can to maximise the potential of your business. Your online security is also important, and choosing an online broker PayPal gives your transactions an extra layer of security. Always develop and stick to a trading plan; it’s a time-consuming endeavour, but with all the tools that modern technology puts at your disposal, it can really help you make significant gains.

Did you know

The nextmarkets team values your future success as a trader, so we put a number of measures in place.

- You can get started with just £500

- We have backing from renowned global investors FinLab, Peter Thiel, Falk Strascheg and Founders Fund

- All funds up to £100,000 are insured by the Financial Services Compensation Scheme

How online trading defined modern finance

Transactions in modern financial markets are governed less by human beings shouting commands and pushing paper and more by computers and software. This shift affects tens of trillions of pounds around the world, and it shows how online trading now defines modern finance. Markets always go up and down, but the technology associated with online trading has led to lots of trading being done by algorithms and programmes rather than people, executed in a fraction of a second.

People who want to succeed in online trading need to understand the ins and outs of how it works; even veteran traders have had to learn about all the changes that have come with new technologies. The nextmarkets platform is designed to make this learning process as natural and intuitive as possible.

Short-term online trade meaning

What is Day Trading? Day trading is one of the most common approaches people take. It’s a trading strategy for the short term, wherein you buy and sell securities within a single day session. This type of trading used to only be carried out by professional traders, but with the range of online free CFD software and platforms like nextmarkets, non-professional traders can also engage in this type of trading.

There are various types of Day Trading, and different traders will learn to specialise in certain methods. Day Trading can be a fast way to make big gains, depending on the accuracy of the data in your research. It’s an ideal way for novice investors to get a feel for online trading, and can lead you into taking your trading to the next level.

A successful online trader defined

There are many things you must do to be successful as an online trader, and as such there are various traits that will make you a good candidate. Success involves lots of planning and strategy, so it helps to have a head for numbers and to be very disciplined.

Patience is key to ensure you wait for the right moment to execute a buy or a sell, and you will need a strong work ethic to keep up with the vast amounts of study and research you will need to do. Being tech savvy is important because there are many technological tools and resources in online trading to help you succeed, so making use of them is important. You also need to have the capital to invest, but a good mind for ensuring you protect your capital as you seek out a profit in the markets.

Important online trading considerations

There are a few things you must think about when you look for the right broker to start your online trading journey. First, consider how much money you plan to invest, as most brokers have a minimum opening deposit. You also need to think about how frequently you intend to trade because some brokers will charge you for account inactivity, while others charge a high fee per trade.

Your experience level should tell you how much support and guidance you are likely to need; some brokers offer very little, while others like nextmarkets offer a great deal. And you will also want to consider your online broker payment options when making a decision. You will know your intentions and your needs, and it is important you take all of these things into account when deciding on the right broker for you.

Discover online trading for free

nextmarkets is an innovative forum where you can learn how to be an online trader before capitalising on spectacular investment opportunities and cutting-edge analysis to boost your prospects of conquering the financial markets. We focus on training and supporting our clients on their journey to success, offering the best tools and resources available.

And we offer a demo platform where you can try before committing to a real money account. Register today for the best trading app and start practising with our free demo platform, where you get £10,000 of virtual money to test the waters with. Your online trading career starts here.

- What are Shares?

- What are Stocks?

- Economic Indicators

- What is Swing Trading?

- What are CFDs ? | What is CFD trading? | nextmarkets

- What are Stock CFDs? | Share CFDs Explained | nextmarkets

- What is Forex? | Definition & Meaning | nextmarkets

- What are Forex Signals

- Forex Economic Calendar

- Forex Trading Hours UK

- What are Forex Indicators

- What is Day Trading?