Europe’s commission-free online broker.

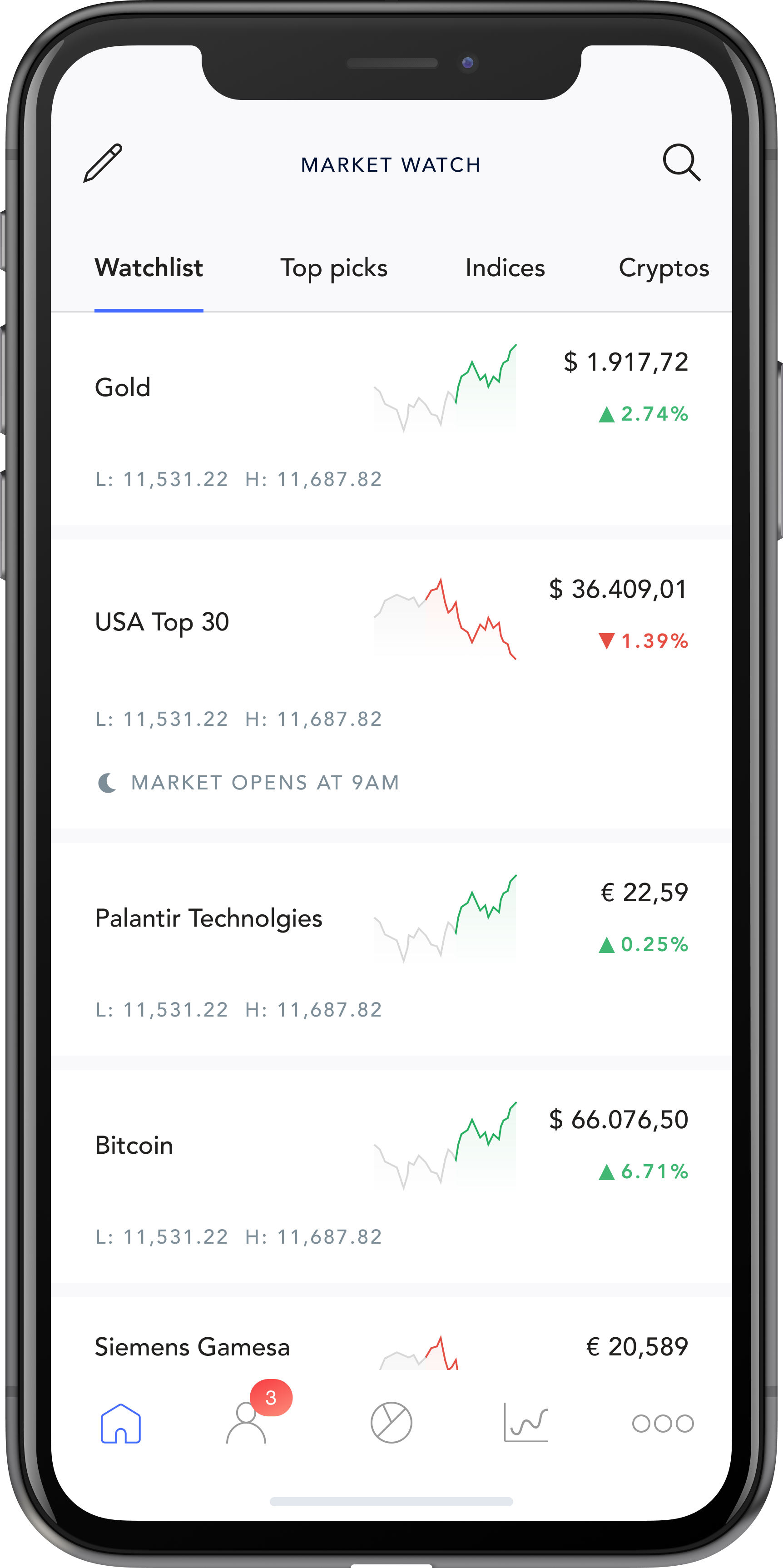

At nextmarkets, you pay neither order and custody fees nor hidden costs such as flat rates or third party fees. Rely on the European online broker with first class execution via the gettex exchange in Munich and an award winning app. Trade our vast universe of products with leverage on demand. Experience what it's like to invest with the company of professional trading coaches.

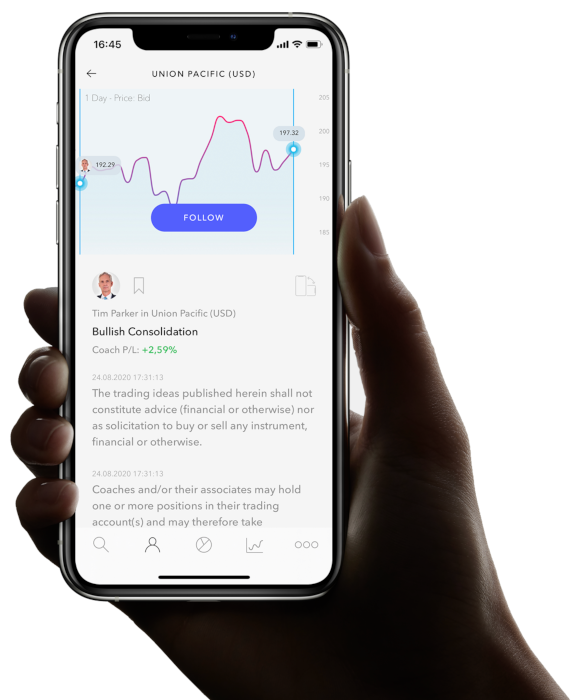

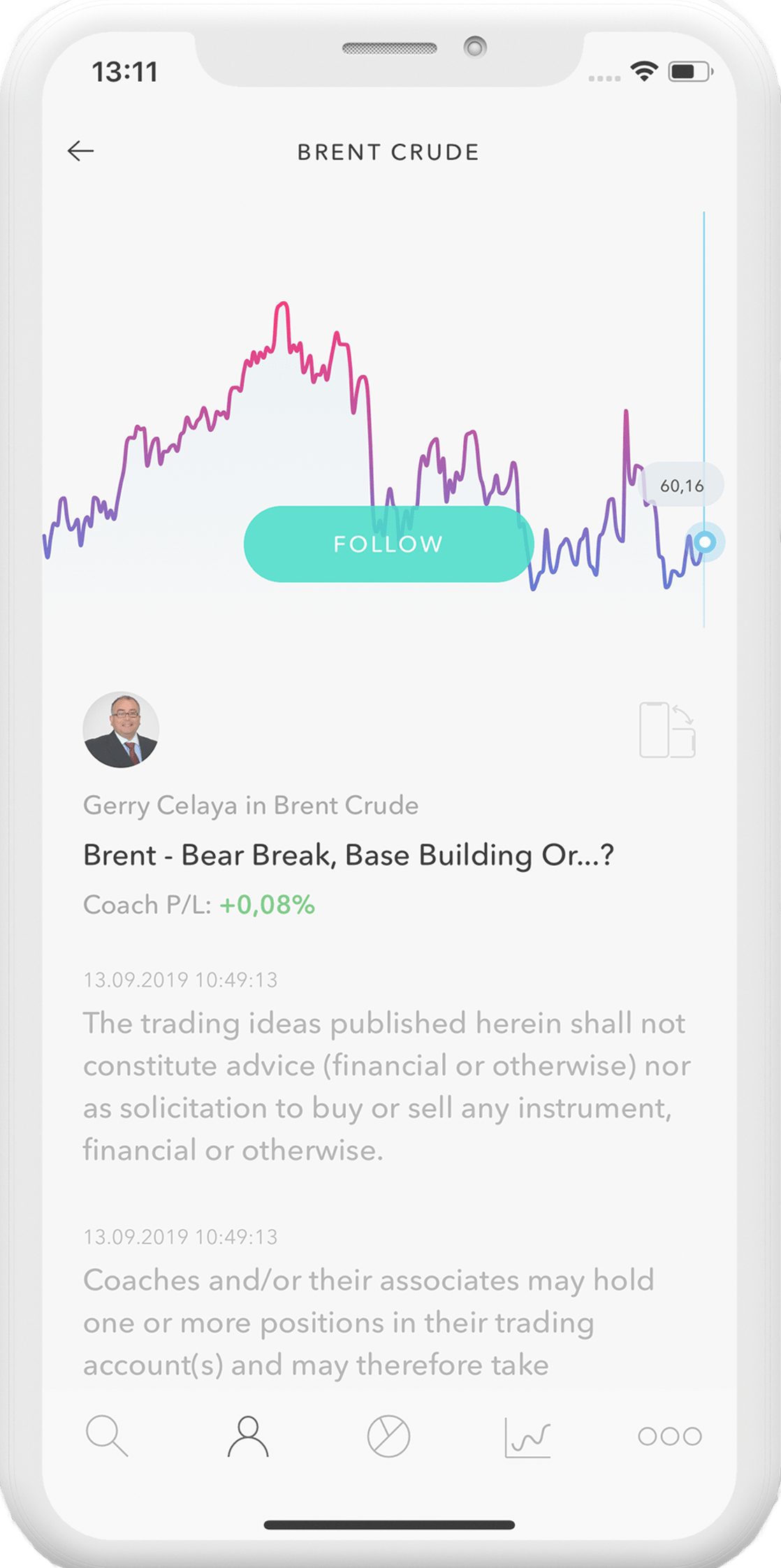

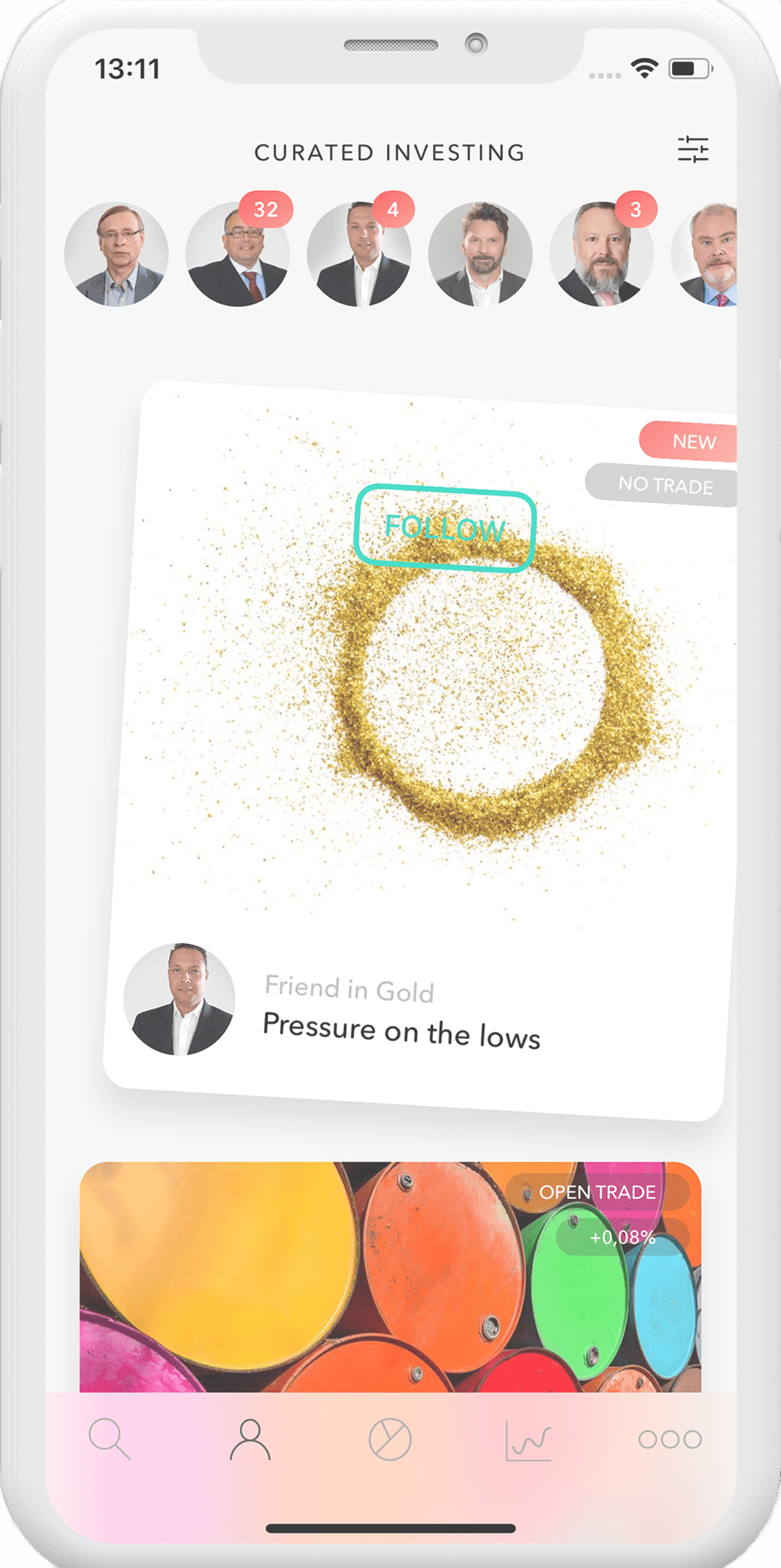

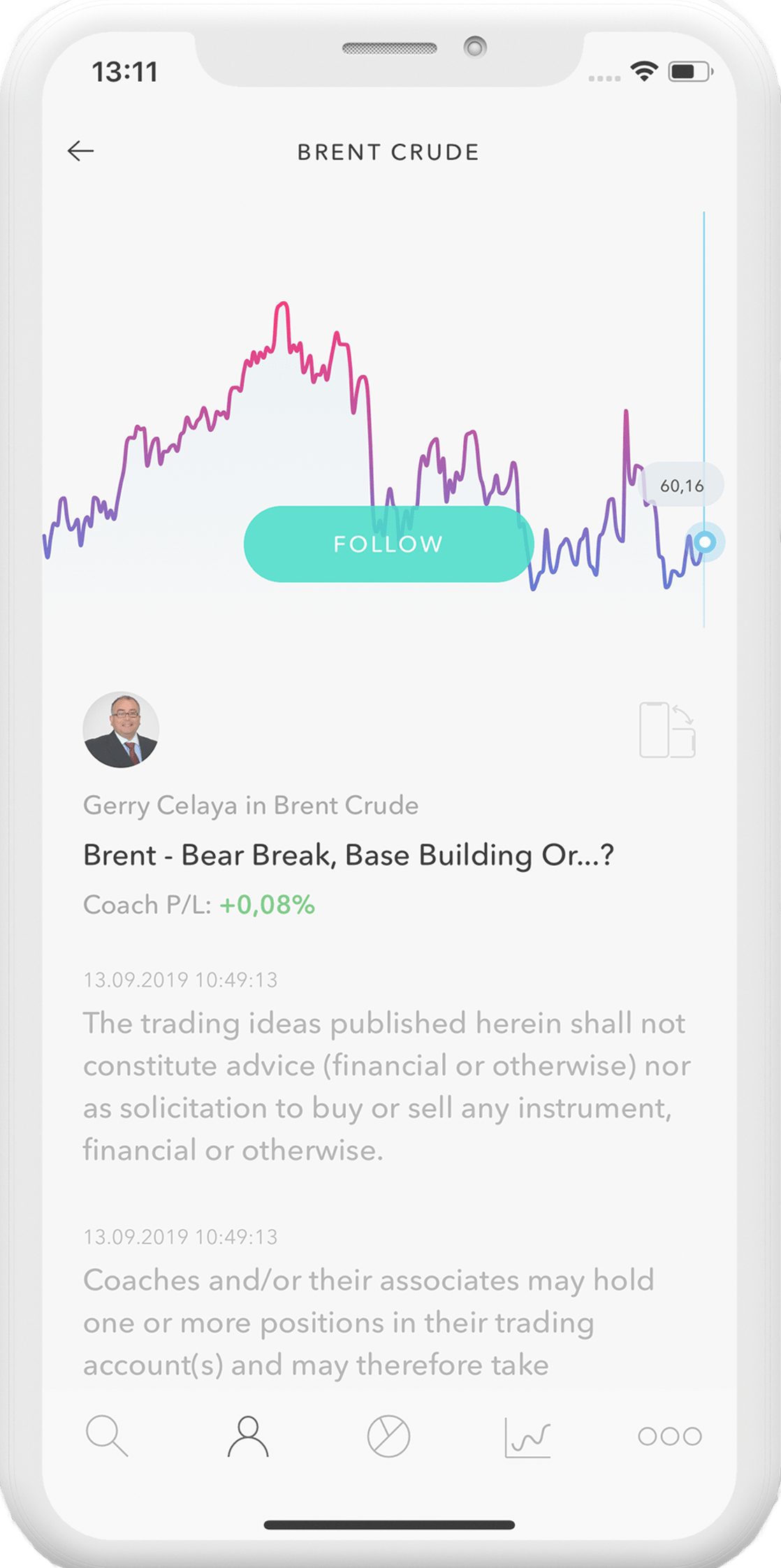

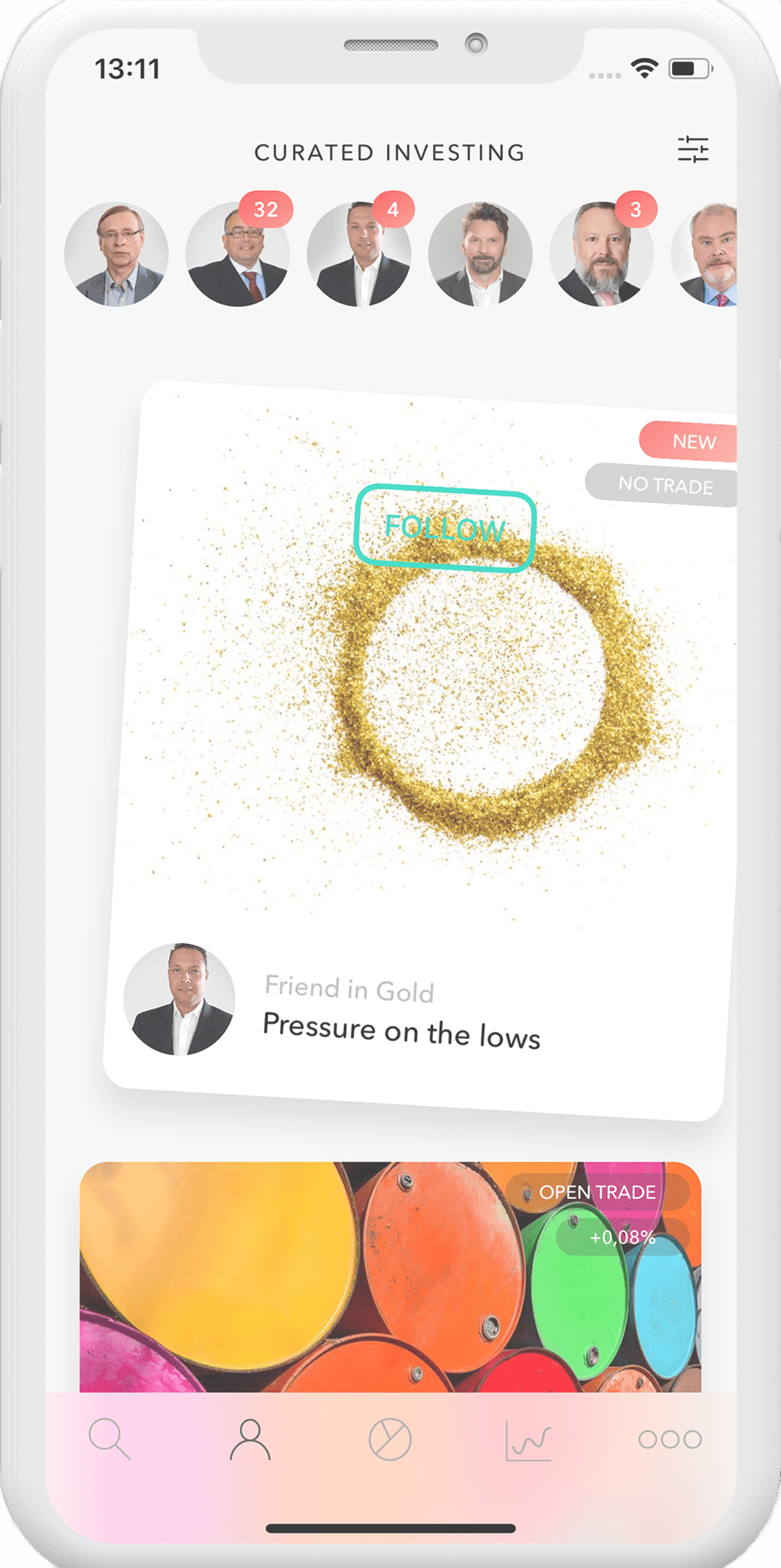

nextmarkets not only gives you the opportunity to trade free of charge as a self-decider, but also provides you with more than a dozen stock market coaches. In this way, you receive up to 300 analyses per month in real time. To learn, analyse and follow.

More about nextmarkets

Wide selection

Trade more than 8,000 shares, ETFs and other products.

No charge

0€ order fees, no custody account management fees & no flat-rate third-party fees.

No incidentals

For dividend payments and trading of rights.

Smart investments

No problem with our selection of over 1,000 ETFs.

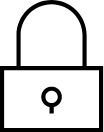

Apps for all platforms.

Your portfolio always at hand, thanks to our iOS, Android and Web Apps.

Expert-curated investing comes for free

Benefit from 22 Tradingcoaches with up to 300 real-time trading ideas per month.

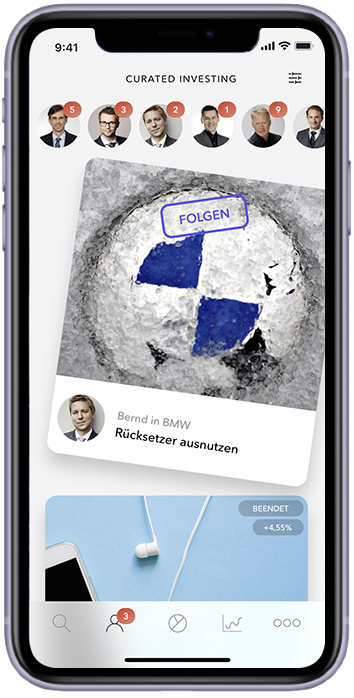

Add leverage seamlessly and on demand without ever leaving your order mask. Get more flexibility with your brokerage account.

Learn more about CFD trading

German Headquarter

Our headquarter is located in the heart of Germany.

Client Funds

Your deposits will be held at Barclays.

European regulation

We may offer our product throughout Europe (MiFID).

Thanks to a lean corporate structure and a high degree of automation, we can eliminate order and custody fees. We pass this cost advantage on to you. In addition, we provide you with more than a dozen trading coaches who uncover real-time trading ideas on a daily basis. Expert-curated investing helps you to crush your trading goals.

It takes you just five minutes from account opening to your credit card deposit.

Open your account hereHow does the account opening works?

You can open your nextmarkets account easily via our website or by your smartphone. The requirements are that you are at least 18 years old.

How is commission-free trading possible at all?

nextmarkets, like any other online broker, receives rebates from the markets on which the transactions are executed (payment for order flow). Due to our proprietary technology and unique corporate structure, we are able to eliminate order commissions that are usually paid by investors.

Is nextmarkets a bank?

nextmarkets is a German company based in Cologne. Through our subsidiary in Malta we are licensed to offer securities trading and to act as portfolio manager and are allowed to offer our product throughout Europe.

How can I deposit funds?

At nextmarkets you can either pay by bank transfer or by credit card (Mastercard, Visa). If you pay by credit card, the money is immediately available for trading.

How is my money safeguarded?

The money of customers in other European countries is held in a trust account with Barclays.

How does the settlement of my trades work?

The settlement is done via the trading segment of the gettex exchange in Munich. Price quality and investor protection are guaranteed by a set of exchange rules and regulations and a trade monitoring center. This means that you not only benefit from the legal security of the transaction, but also from full transparency before, during and after trading.

What financial instruments are available?

You can invest in more than 7,000 shares from 52 countries, as well as in over 1,000 ETFs. Our trading hours are from 8am to 10pm CET. You can also trade all shares and ETFs as CFDs with leverage. In addition, all major indices, currency pairs, bonds and commodities are available as CFDs.

At what prices do I trade?

You trade on the gettex trading platform operated by the Munich Stock Exchange segment. The price quality is monitored by the exchange.

What types of orders are available?

With nextmarkets, limit and stop orders are available in addition to the market order.

Any other questions?

Welcome to nextmarkets Support