CFD trading strategies - start trading at nextmarkets

CFD trading gives the opportunity to speculate on price movements, without the need for owning an actual asset. While price movements are a relatively simple calculation, CFDs involve high risk and therefore careful planning and strategy are required. With nextmarkets, you’ll have access to the CFD trading strategies of the professionals via a dedicated, easy-to-use app that puts a personal broker in your pocket. Think of it as something like trading courses where you can learn all about financial markets, CFDs and all types of strategies.

Trading Contracts for Difference (CFD): strategies explained

If you’ve got some capital and have already read up on the basics of long or short term trading strategies, you might think that it’s time to open a CFD account at nextmarkets and begin investing. However, it’s important not to rush into things. Randomly deciding to make trades won’t get you far.

From day one, you should treat your Contracts for Difference account as a business – the onus should be on improving constantly while you make money. You should also be aware that sometimes the markets can be unpredictable, and that even the best traders close the day on a loss every now and then. It’s important to make educated trading decisions by using a combination of CFD trading tips and strategies.

Get free CFD trading tips at nextmarkets

It’s a common misconception that in order to access any sort of trading plan, you’ll have to pay a premium price. nextmarkets provides you with free access to the tips of the professionals, and you’ll even have the chance to mirror the movement of the experts.

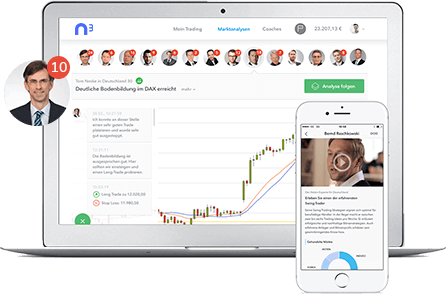

From here, you’ll be able to gain an insight into how the industry works and develop your own strategies based on what you learn from the nextmarkets experts. Alternatively, you can continue to copy the pros if you’re comfortable making low-risk investments. Another industry secret is to sign up to podcasts and newsletters by other famous traders to get inside information on their strategies.

CFD trading methods explained

Investors, be they retail investor accounts or individual investors, generally have to make several decisions about their trading positions on a daily basis. Long vs short, long term vs short term, speculation vs hedging and trend vs swing are all common dilemmas with day trading and long term trades. The following are common strategies employed by the experts at nextmarkets:

- Swing trading: attempting to benefit from reversals or “swings” within trends of the current market price (when a high price inevitably drops slightly, for example).

- Hedging: this protective strategy involves stopping open positions from losing value by taking an opposing CFD position. Such distribution is where the term “hedging your bets” originates.

- Long vs short: purchasing an asset is known as a “long position” – on the assumption its sell price will gain value over the length of the contract. Shorting is when the investor sells back an asset at a low level, with the intention of purchasing it back at a more favourable buy price at a later date.

Online CFD strategies UK-wide

While the basic strategies help you to exploit the potential to make money from trading Contracts for Difference, there are hundreds of complex strategies to consider that could help you achieve maximum gains. It’s therefore important to identify your investment goals and needs and then adopt CFD strategies by nextmarkets that help you meet these objectives.

The nextmarkets best online stock broker app in the UK provides you with insights and tutorials on how to develop your strategies for free – in next to no time, you should have an understanding of breakout trading, range trading, news trading and momentum trading.

Fact Check

If you want to find out how nextmarkets could help you develop your CFD trading strategies, the best way is to download the free app for Android or iPhone. With a demonstration account, you’ll receive access to all of the insights and analytics available to real traders You’ll learn about things from understanding the difference between the buy price and sell price, how an underlying asset works and much more. Here are just a few reasons why you should open a nextmarkets account:

- It features an easy-to-use yet powerful interface

- You’ll gain advice and dedicated support from expert traders

- You’ll receive up to 200 curated investments every month tailored to your style

Risk management when trading CFDs with nextmarkets

Once you’ve opened a CFD account at nextmarkets and got the hang of investing with virtual demonstration funds, you might feel like it’s time to begin with real money. However, implementing risk management when looking to trade CFDs is one of the most important lessons to learn, and you should always look at securing your financing costs before you make the jump to real money.

One popular way to achieve this is to adopt the “one per cent” strategy – this involves never investing more than one per cent of your overall funds on a single trade. This way, you won’t start losing money rapidly if the markets take an unexpected downward turn. Remember that occasional losses are part of trading, and never risk more than you can afford.

Why automated analysis is important

It’s imperative that you implement technical analysis into your CFD trading strategies if you want to succeed. It’s possible to build up predictions of how future CFD prices could be impacted by taking a look at previous market data.

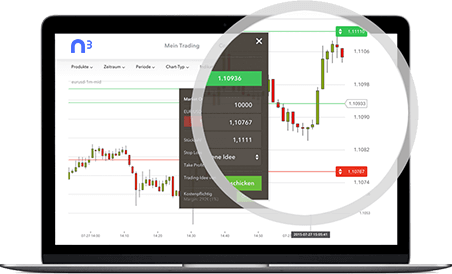

By using a nextmarkets CFD trading app that automatically analyses previous data and combining these automated findings with a bit of common sense, you should be well on your way to enjoying CFD trading success. All good CFD apps should be able to offer insights in the form of automated analysis, charts, graphs and more – don’t settle for a platform that doesn’t provide you with this.

Simple online CFD trading strategies

When learning about at nextmarkets, beginners are advised to keep CFD trading strategies as simple as possible. Taking a risk without having an understanding of the market can lead to experiencing losses, which is why it’s so important to choose free CFD software that offers help and advice. The following are some of the simplest CFD trading strategies to implement:

- Breakout: spotting the potential signals that a new upward or downward trend is beginning.

- Moving average crossover: overlaying old price data with recent price data to spot trends. When the two lines meet on the graph, this could be evidence of a movement.

- Carry trade: profiting from interest received on bonds that exceed the cost of financing the debt of another trade or loan.

Developing your CFD trading strategies

While you might be eager to develop your own strategies, it makes sense to open a trading account with a platform that provides you with the help and advice needed to succeed on the market. The nextmarkets app features tutorials and professional analysis that have carefully been selected to provide traders with the optimal experience.

You can even copy the Contracts for Difference trading strategies of the nextmarkets professionals if you’re new to trading or simply want to try a new approach. Heed the advice of the experts, take what you learn from them and put your own spin on things to develop unique long or short term trading strategies.

Flexible deposit options

The days of having to provide your bank details to every company you transact with are over. Modern, flexible payment gateways allow for secure deposit options. Many apps recognise this, which is why it’s not uncommon to find CFD broker PayPal payments as standard across several platforms. In addition to flexible payments, the nextmarkets CFD trading app provides help and answers to even the most basic questions like “what is CFD?” and “what are CFD stocks?” to help you get up to speed with how CFD trading works before you invest with your own funds.

Finding the best CFD trading tactics

The best CFD tactics will vary depending on market conditions as these are linked to whichever CFD trading strategy investors choose. There’s no hard-and-fast rule to making money from CFDs, although it helps to have access to the very latest insights and analytics.

If your app provides you with curated investment opportunities via push notifications, this will put you at an advantage, as it means you can act quickly to take advantage of current conditions. Perhaps the best CFD trading strategy for beginners is to open an account with nextmarkets platform that offers a high level of support and advice.

Basic tips for trading with nextmarkets

Choosing a trading account that offers support is crucial, particularly if you’re starting out and asking questions like “what are stocks?” and apps are a great choice as they offer tutorials from the experts. New traders are advised to invest wisely through a series of low-risk investments at first. Three of the most valuable tips are when trading with nextmarkets :

- Don’t jump the gun – stick to a maximum of three trades each day

- Dedicate time to monitor the markets – the more hours you put in, the greater insight you’ll have

- Look at what professional traders are doing and mirror their actions to learn the basics of how CFDs work

Did you know?

We care for our customers at nextmarkets. That’s why we don’t charge commission, and it’s why we offer incredibly competitive spreads. In addition to this, we also guarantee the following:

- Flexible withdrawal and deposit options which allow you to trade the way you want to

- Financial backing from the biggest names in the industry, such as Peter Thiel and FinLab

- Deposit protection of up to £100,000

If you’d like to find out more about how nextmarkets could improve your trading potential, why not get in touch with us today? Alternatively, download our powerful app and see for yourself.

What is the most successful Contracts for Difference strategy?

Successful traders understand that minimising the high risk of losing money, maximising profits and emulating professional traders go a long way to ensuring a healthy return on investment. You’re not entitled to receive compensation of any sort if your trade doesn’t work out, Clinging to a losing trade and cashing in too early are two of the easiest mistakes to make, and the following strategies should be implemented where possible:

- Trade on logic, not emotions – analysis trumps gut feeling every time.

- Limit your trades – if you’re investing huge amounts of your total capital, you’re overstepping the market and merely gambling.

- Timing is everything – entering a trade early on could result in serious losses. The same goes for waiting too long. Individual circumstances come into play, so investment research is always key.

- Avoid adding to losing CFD positions – CFDs are complex instruments and come with high risk within volatile markets, don’t expect prices to turn around immediately after they’ve taken a dip.

Follow these trading tips at nextmarkets and enjoy the best possible returns.

Successful CFD trading strategies revealed - avoid losing money rapidly

If you want to be privy to all the latest successful strategies, you’re going to need to arm yourself with a powerful financial instrument and interface that delivers all the latest news and analytics about financial products, direct to your mobile device. This allows you to pounce on market conditions wherever you are, so be certain to choose a platform that offers push notifications and insights from professionals.

Learn to diversify your portfolio, keep a trading journal, take your weaknesses into account and use all of the market insights available to you via nextmarkets. The best traders understand that to successfully trade CFDs there has to be an understanding that there is a trade-off between risk and reward. If the risks outweigh the potential returns, walk away.

CFD strategies for beginners: swing trading

The best CFD strategies for beginners help the new trader to make a reasonable amount of money while minimising their risks. While there’s nothing inherently wrong with diversifying from low-risk strategies from time to time, beginners are likely to find it confusing and overwhelming to implement complex techniques at first.

What is swing trading? Swing trading is one of the easiest strategies to implement, as it helps new traders to stay focused on one particular market. Swing traders tend to avoid false signals because the analysis methods reveal these signals. By sticking to the statistics instead of relying on emotion, there is the opportunity to enjoy a profit from a series of low-risk investments.

Stop losses: CFD strategies UK traders can trust

One of the best ways to ensure your investments are protected is to make use of stop losses. If you trade without a stop loss in place, you could witness a rapid wipe-out of funds. At the same time, trading with a stop loss that is set too tightly could also lead to a more gradual but no less destructive wipe-out.

Learn at nextmarkets how to use stop losses, but remember to give the markets plenty of breathing space – in other words, allow the markets to go about their natural ups and downs. Trading with nextmarkets is a long-term game and those who have the patience to ride it out, often see its rewards.

Combine technical and fundamental analysis

One of the strategies with trading CFDs favoured by many traders involves combining technical (TA) and fundamental (FA) analysis together. By implementing both of these methods, a CFD trader stands a much better chance of being successful than someone who uses just one of them.

As a general rule, traders should aim to use FA to trigger a trade, while using TA to predict the best possible time to enter a CFD trade. If you want to learn how to trade CFD in more complex ways you should choose the nextmarkets app that offers plenty of tutorials, insights and analysis.

Learn how to trade with nextmarkets today

If you’re a newcomer to the financial markets or would like to improve your existing strategies when trading CFDs, it makes perfect sense to try the UK’s most powerful trading platform. With a nextmarkets CFD trade account, you’ll receive over £10,000 in virtual funds to trade with, which allows you to perfect your technique without the high risk of losing money rapidly.

CFDs are complex instruments and come with very high risk so the more trading experience you can gather on the market, the better position you’ll put yourself into to successfully trade CFDs, minimise the risks involved and get yourself well on the way to making more money.

Downloading the app is easy, and all you’ll need to sign up is an email address. Why not get involved and take your first steps towards becoming a CFD trading success? The platform, resources, training, and materials are already in place for you to become a trader, so why not open a trading demo account and start trading today?

- Forex fibonacci trading strategy

- Best forex scalping strategy

- Forex trading strategy - Best forex strategy 2023

- Scalping Strategy

- Bollinger Bands Strategy

- Donchian Channel Strategy

- Momentum Trading Strategies

- Best swing trading strategy

- Hedging Strategies

- Trading Tips and Strategies

- Best Day Trading Strategy 2023

- Forex trading strategy for beginners