What are the trading fees and costs on nextmarkets?

When choosing an online broker, the fees and their presentation play a particularly important role – this applies to beginners as well as experienced traders. The most transparent presentation of costs is a characteristic of reputable providers and allows potential clients to see at a glance what they can expect for their trading account.

A complicated fee structure is, therefore, a nuisance for every trader, because after all, you’ll want to concentrate on trading, and not on commission fees. This is why nextmarkets costs can be seen at a glance, and traders do not have to worry about hidden nextmarkets fees.

No special offers at the nextmarkets costs

If you are interested in our offer, you will notice one at first sight: There are no discounts with us. This is because nextmarkets charges and conditions are good from the outset. We do not believe in attracting new customers with short-term discount campaigns and prefer to rely on consistently favourable trading conditions, good service and our unique selling proposition, curated investing. We don’t need a nextmarkets bonus to keep our traders happy.

As we are fully convinced of the quality of our offer and our comprehensive services, we believe it’s fair if our customers can test us for free first – as long as they want to. This way, you’ll join us because you are convinced of our services and because you consider nextmarkets costs to be reasonable.

All nextmarkets fees at a glance

If you would like to find out about the nextmarkets costs, go ahead! You can see at a glance on the website the fees that are coming your way. At nextmarkets there is only one account model, so there are no gradations of services or tradable values associated with hidden fees or additional costs. We also do without a special account for traders with higher trading volumes. Instead, nextmarkets fully covers costs and expenses via the spread.

So with nextmarkets you only pay fees when you place an order. The size of the spread depends on the underlying of the CFD in question – but you can view all spreads directly on our website in a table and never buy a pig in a poke at nextmarkets. In addition, our spreads are not only rated as favourable by our traders, but also in reviews in the trade press and on portals.

No further nextmarkets costs

Beyond the spread, we do not charge any nextmarkets fees – not even hidden. Possible costs that traders have to expect from a broker include fees for maintaining the trading account, fees for providing real-time quotes, additional costs for activating products and services classified as premium services – none of these are found in a nextmarkets account. You can rest assured that there is no nextmarkets fraud.

We also avoid further more or less hidden costs, for example for deposits and withdrawals. Especially when it comes to the payout of winnings, brokers are quite happy to take action again – be it through minimum payout amounts, processing fees or weekly or monthly limits. You won’t find any of this at nextmarkets. Our motto for the fee structure: You get what you see. Because you should be able to devote yourself to trading, not to studying your broker’s conditions.

No nextmarkets fees for deposits and withdrawals

In your personal customer portal, you can overview all nextmarkets costs. After a short time, you will notice that your profits from trading activities remain undiminished – even when you deposit and withdraw. You can transfer your returns to your reference account as often as you like, because nextmarkets costs for withdrawals are set at zero. With us, there are no limits for free withdrawals and no minimum amounts. The only restriction you have to observe is to cover your open positions – there must be sufficient safety margin.

Any free capital in excess of this is available to you without restriction. Nevertheless, in individual cases, fees may be charged for deposits or withdrawals, although not by nextmarkets. Costs may be incurred due to fees charged by your financial service provider. We therefore recommend that our customers check the fees that arise when using VISA or Mastercard or SEPA transfers through their own bank.

Fact Check

With nextmarkets you can fully understand what costs you will be facing. Because nextmarkets fees are not a nested construct – you only pay the spread and therefore only if you actually trade. There are no hidden costs and no surprise settlements for additional services.

- Clearly structured fees

- Costs are only incurred for the spread

- Uniform account model

- Trade now free of charge on nextmarkets!

- Learn forex trading

All-inclusive model for nextmarkets costs

With its fee structure, nextmarkets would like to ensure that newcomers in particular find access to trading without having to pay attention to open or hidden additional costs. That is why we only charge fees when you trade. With nextmarkets costs, there is no inactivity fee, which we would charge you if you did not trade for a while. This also sets us apart from the majority of CFD brokers.

- No nextmarkets account management fees

- No commissions

- No additional nextmarkets costs for coaches

- Financing via spreads

Our fee structure is the result of lengthy deliberations regarding the form in which nextmarkets GmbH communicates its brokerage services. This is why we have also abandoned the subscription model that was initially planned and include the coaching of our financial experts in our offer – even with the demo account. The same applies to the provision of real-time quotes and educational offers.

Trading School from nextmarkets

Our coaching: no additional nextmarkets costs

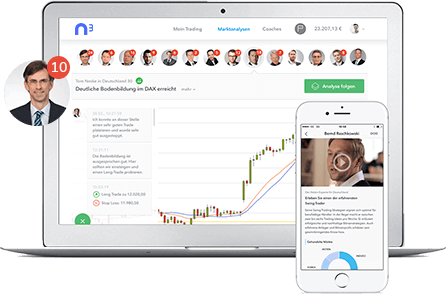

No nextmarkets fees even for coaching! Our concept of Curated Investing, accompanied by proven financial experts, is clearly our unique selling proposition. From the very beginning, after we had dealt with the questions “How to become a broker” and “What do we want to offer our clients”, we knew that we wanted to stand out from the crowd. Of course, we could work out a separate fee structure for the scope and content of the coaching, but we decided against the possibility of a coaching subscription. At nextmarkets, you learn how to become a broker from professionals. Our coaches are stock exchange traders, investment bankers or fund managers with many years of experience and provide up to 200 analyses per month.

This is free of charge for you – follow the coaches whose strategies you are interested in, copy what you think is relevant, when opening a position you only pay the spread. Our trading coaches will show you how they arrive at their trading decisions and how, for example, entry and exit times or limits are determined. This way you don’t have to rely on mere copying, but learn to understand the background of trading and can use this for your own strategies.

Test nextmarkets - there are no costs

Before you decide to set up a trading account with nextmarkets, you can test our offer almost in its entirety, with no time limit. With our free demo account, you can trade in a realistic trading environment with risk-free virtual credits. And even with the demo, you can use the analyses of the nextmarkets coaches.

By doing so, you have the opportunity to form your own opinion as to whether the concept of Curated Investing, as offered by nextmarkets, is a suitable method for you to enter CFD trading. However, we don’t limit ourselves to the analysis of our experts, but also provide you with educational resources to accelerate your progress in trading. Again, there are no additional nextmarkets costs.

nextmarkets educational offers are also included

nextmarkets also does not ask for additional cash for the training materials we provide to our traders. The content of the exclusive on-demand videos explains topics on important topics, so that you can get to know different areas better, from the handling of the stock market software and the individual asset classes to strategies. With our training videos we teach you, among other things, the important topic of risk management, medium or long-term strategies, the special features of day trading and the various forms of analysis.

The nextmarkets Trading School videos are also part of our services. They round off the analyses of the coaches. Further important information is available through the nextmarkets Newsletter and webinars. In this way, we provide you with basic knowledge in trading and keep you up to date on events and trends that you should know about. You don’t have to reckon with further nextmarkets costs for using the training offers, and you can already test a large part of the offer with the demo.

Did you know?

nextmarkets is a broker with transparency in all areas. This naturally includes the nextmarkets costs and fees, the account models, but also information about the company, regulation and custody of customer funds.

- Uniform trading account, free demo

- No other fees except the spreads

- European regulation and Maltese deposit insurance

- Trade now free of charge on nextmarkets!

- Forex Demo Account

No additional contribution to nextmarkets costs

nextmarkets is not only serious when it comes to trading costs. There is also no obligation to make additional contributions, because nextmarkets is a broker with European regulation. The brokerage offer of the German nextmarkets GmbH is provided by the Maltese nextmarkets Trading Limited. As Malta is a member state of the European Union, CFD brokers located there must be regulated by the local financial supervisory authority in accordance with the requirements of the European market supervision.

Among other things, this stipulates that there is no obligation to make additional contributions to brokers within the EU. The “margin call” sounds harmless, but it means that traders get into debt with the broker if their trading account falls into the red. Depending on the (previously extremely high) leverage, enormous sums could accumulate here. Traders need not worry about this at nextmarkets, because if there is a risk that the trading account will reach negative balances, all open positions are closed immediately. This means that you can lose at most the deposits on the trading account – we cannot and do not want to charge you for further nextmarkets costs.

You may assume the proper management of your money

The European regulation protects traders in nextmarkets from having to make additional payments, but has other advantages as well. For example, our customers’ deposits must be held separately, in segregated accounts that are separate from the capital of nextmarkets Trading Limited or nextmarkets GmbH. Should we – which we do not assume – become insolvent, creditors of nextmarkets would not be able to hold themselves harmless from our customers’ capital.

- No obligation to make additional contributions

- Segregated customer custody

- Leverage according to ESMA specifications

Here too, we protect you from unforeseen costs and losses. nextmarkets offers a deposit protection insurance of up to £100,000.

Investor protection through leverage complies with EU requirements

As a private investor, you enjoy additional funds protection with nextmarkets, as a result of limited leverage. Since August 2018, the European market supervisory authority has provided a limitation of leverage in CFD trading. The previously possible, sometimes very high leverage of up to 1:400 is now prohibited. Traders trade on nextmarkets with levers that range from 1:2 for crypto CFDs to 1:30 for Forex majors, depending on the asset class.

If you wish, you can also trade without leverage until you feel more secure. In addition, the coaches in Curated Investing will also teach you which strategies you can use for personal risk management. In this way, we want to ensure that your nextmarkets experience is as unclouded and safe as possible.

nextmarkets Broker

Trading with the Webtrader without further nextmarkets costs

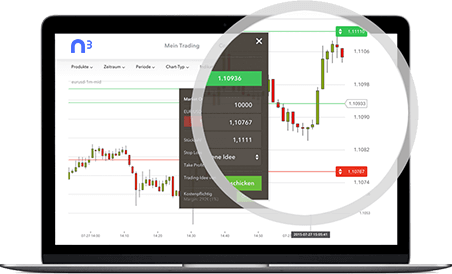

Another component of our services, where you do not have to fear any additional fees, is the stock exchange software. You can already test the functional range of the Webtrader with the demo account. If you then decide to set up a real money account, the Webtrader is available to you without any restrictions. This means that nextmarkets does not incur any costs for the activation of certain functions or for real-time quote packages. Our browser-based trading platform was developed in the style of the popular MetaTrader.

Take advantage of real-time quotes for all tradable securities, various options for chart display and analysis and the most important order types. All the tools you need for your own analyses are integrated into the software, and you can follow and copy the strategies of the 14 nextmarkets coaches from the chart. In addition to the web-based platform, we also provide you with apps for iOS and Android-based mobile devices – also without additional nextmarkets costs.

Invest from the trading account without additional costs

At nextmarkets, we not only want to provide our traders with a solid CFD trading offer, but we are constantly working to expand and improve our services. In view of the low-interest rate policy that makes it difficult for German investors to build up assets, we give our traders the opportunity to invest directly from the trading account of nextmarkets with smart investment products. So you do not need a custody account with the associated costs with us.

One of the products we have been offering since the end of 2018 is our Savings CFD, which uses the difference between the German and US base rates and enables a return between 1.50 and over 2%. There are no separate nextmarkets costs for the savings CFD. You can also trade CFDs on the Real Estate Index and the Green Index with and without leverage.

We do not have to shy away from comparison with other brokers. We also waive nextmarkets fees for inactivity, for deposits or withdrawals or for setting minimum withdrawal limits. The use of the stock exchange software, real-time quotes and educational offers is also fully integrated into the concept of financing all costs incurred via the spread. We rely on this transparency to convince our customers.

Customer service without time and expense

You can also save costs by contacting nextmarkets customer service. Although nextmarkets Trading Limited is based in Malta, support is provided by nextmarkets GmbH in Cologne. You can therefore contact our team during the week during normal office hours via our Contact Us form. We also have an in-depth FAQ guide in place to answer any queries you may have about your account or your trading options.

Conclusion: nextmarkets costs are uniform and manageable

At nextmarkets, we want to be as beginner-friendly as possible. Our concept of Curated Investing is a further development of social trading, based on the experience of our founders. In order to make it as easy as possible for newcomers to CFD trading, nextmarkets not only provides them with the support of experienced stock exchange traders, investment experts and investment bankers, but also help them to avoid having to work their way through confusing legal or financial structures.

The offers and services of nextmarkets can already be tested with the demo account without nextmarkets charging any fees. The demo is not limited in time and even allows you to follow the analyses of the coaches. Those who decide to trade real money will find a uniform account model. The fee structure is also simple and clear – nextmarkets costs only arise when trading, and only via the spread. The favourable spreads depend on the asset class of the underlying instrument and can be viewed on our website.