nextmarkets GmbH - Malta and Cologne as headquarters for the broker

With Curated Investing at nextmarkets GmbH, beginners should be able to take their first steps in CFD trading under guidance. The consideration of the founders: More than three-quarters of the private investors make losses in the long term when trading contracts for difference. But does that have to be the case? And how can it be changed?

Hardly any other team had better starting conditions for the ambitious project to make trading easy to learn than brothers Manuel and Dominic Heyden. In addition to their relevant financial and IT experience, both brothers have already had considerable success with the launch of the social trading provider ayando. The nextmarkets GmbH goes even further.

Ambitious company with high goals

Manuel Heyden, the CEO of nextmarkets GmbH, was able to gain his own professional experience in investment banking. Even then, he noticed that many investors fail on the stock market – and he wondered why it should not be possible to learn trading under the guidance of experts, much like a sport or a musical instrument. This idea led Manuel and his brother Dominic, now the CIO of nextmarkets GmbH, to be the first to found the social trading platform ayando in 2008. With this offer, beginners should be able to follow truly successful role models and thus trade more successfully.

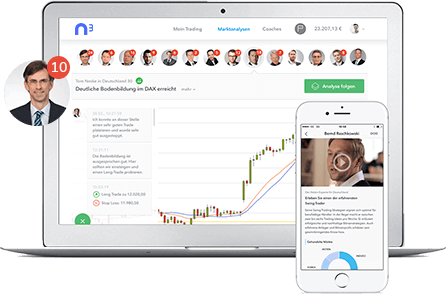

With nextmarkets GmbH, the two brothers go one step further: here the role models are not other, more successful traders, but proven financial experts. By gaining insights into the strategies of the 14 coaches, traders should gradually improve their knowledge of the markets and thus reduce the risk of investing irrationally.

At nextmarkets GmbH, traders are taken by the hand

“How to be a broker” and “What do I want to offer my clients?” – these and other questions are probably the most important ones for every potential financial service provider. The Heyden brothers have been able to position themselves so successfully with nextmarkets GmbH because the company’s range of curated investing products differs significantly from the business models of other brokers. The team includes a total of 14 coaches. The experts from the world of finance and investments allow traders to gain insight into their strategies. As a client with nextmarkets, you can use up to 200 analyses per month to make rapid progress and develop a better understanding of strategies.

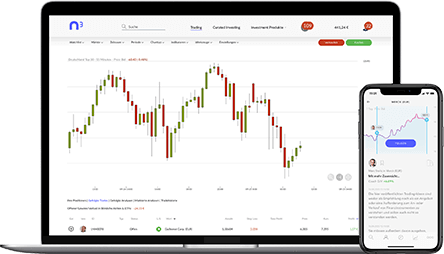

The management of nextmarkets is sure of success, which is why you can already follow the analyses of the nextmarkets financial experts directly in the chart with the free demo account. Since the trading strategies of the experts can be fully understood, you don’t have to simply copy them. Instead, the focus is on a new kind of learning experience that will gradually and fundamentally change your CFD trading behaviour.

nextmarkets GmbH: Clarity is trumps

Alongside its Curated Investing, the company wants to make trading more accessible to newcomers. The entire structure of nextmarkets GmbH and the Maltese company is designed to facilitate the first steps in CFD trading. This has been achieved through the minimal nextmarkets costs, the account model and the development of the web platform – as well as the educational offer of the nextmarkets School. The beneficial effect of this is that traders do not have to spend any time trying to understand their broker. Instead, they can concentrate on improving their knowledge of the stock exchanges, the markets and the processes involved in trading.

Thanks to the integration of expert analyses, you have the opportunity to better understand economic backgrounds, how the analysis works, and why certain trading approaches are chosen – and thus to trade more successfully yourself. A well-rounded educational offering with exclusive video material supports this as do the webinars of the nextmarkets School.

A trading offer that allows for in-depth analysis

The composition of the trading offer at nextmarkets GmbH is designed in such a way that all relevant asset classes are represented. Tradable via CFD are currency pairs, indices and shares, bonds, commodities, precious metals and energies, but also the two strongest crypto currencies Bitcoin and Ethereum. With over 1,000 securities, the company’s trading offer is extensive, but not huge.

There are good reasons for this – because in this way the available asset classes and values are covered by the knowledge of the 14 nextmarkets coaches, who can provide solid analysis and represent trading strategies that cover the entire spectrum of CFD trading. If you take a closer look at the profiles of the coaches, you will see that they have very different focuses and strategies. This gives you the opportunity to learn about the approach to trading from several perspectives and choose what suits your own preferences and risk appetite.

Fact Check

nextmarkets combines the innovative potential of the German FinTech company, nextmarkets GmbH, with the brokerage services of the Maltese EU-regulated company nextmarkets Trading Limited. You benefit from the experience of the founders and financial coaches within the framework of the unique Curated Investing.

- Coaching by experts in Curated Investing

- Transparent structure

- Maltese regulation

- Trade now free of charge on nextmarkets!

- Learn forex trading

Making trading traceable

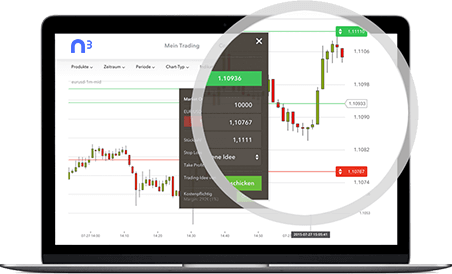

The current strategies of all 14 coaches are integrated into the stock exchange software of nextmarkets GmbH. By selecting an expert, you can view their analyses. The number and regularity of the analyses differ, as do the trading preferences and markets. To ensure that you really do find a representative selection, the technical analysis is represented just as much as the fundamental analysis.

Thanks to the news feed, in which coaches provide detailed information on the considerations on which their trading decisions are based, you can easily understand why the expert of your choice is trading in this way. As your understanding of the markets increases, the coaching should guide you step by step towards your own strategies. And when you are sure you have understood a strategy, you can follow the experts’ recommendations with just one click.

Trading School from nextmarkets

Who are the experts for Curated Investing?

All 14 coaches at nextmarkets GmbH have a solid professional background in the financial industry. They bring their experience as investment bankers, fund managers or stock exchange traders and are known in the financial community for their expertise. We have taken care to cover the entire spectrum of opportunities when selecting the professionals. That is why our coaches include successful day and swing traders as well as financial experts who prefer medium to long-term strategies and have a rather quiet trading style.

- In-depth professional experience

- Different analysis preferences

- Short, medium and long-term strategies

Our coaches also have their preferences when it comes to analyses. Technical analysis, i.e. recognizing patterns in the chart, is well represented. You can even choose from individual focuses in the coaches’ preferences for certain indicators or oscillators. However, analysis based on fundamentals is also represented, as is strictly rule-based investing.

How is the company behind the brokerage offering organized?

While nextmarkets GmbH is a leading provider for innovative coaching, we understand that other criteria also play a role when traders decide on a CFD broker. One of the most important is the question of deposit security – before you open your trading account, you naturally want to be reassured about the safekeeping of client funds. First of all, nextmarkets is a German FinTech company, nextmarkets GmbH, founded in 2014, is based in Cologne. Thanks to the “head office” in Cologne, you benefit from German administration and, of course, German customer support.

The brokerage service is a subsidiary of nextmarkets GmbH. The company nextmarkets Trading Limited is based in Malta and is regulated by the Malta Financial Services Authority (MFSA). Like Cyprus, Malta is a popular location for Forex and CFD brokers, and the regulatory authorities of both EU countries operate to a high standard.

Trading with the security of EU regulation

Maltese regulation ensures that your nextmarkets experience is safe and reputable. As a member of the EU, Malta is also bound by the regulations that apply throughout Europe when it comes to the supervision of financial service providers based there. Therefore, you can assume that nextmarkets, like all CFD brokers in the UK & EU, manages your deposits in segregated accounts, separate from company assets. Even in the event of insolvency, your money would be safe – because possible creditors would have no access to it.

For further protection, nextmarkets Trading Limited is a member of the Financial Services Compensation Scheme (FSCS), providing deposit insurance of up to £100,000.

However, these are not all the advantages of the EU regulation, which also stipulates, for example, that we must not allow your trading account to slide into the red. As soon as a position is no longer covered by the deposited margin, it is automatically closed.

Did you know?

In addition to nextmarkets coaching, European regulation in Malta ensures that you can trade without worrying about the safety of your deposits. nextmarkets GmbH offers you both a detailed FAQ guide as well as an online contact form, should you happen to run into any issues along the way.

- Customer support through nextmarkets GmbH

- Protection of customer deposits in accordance with EU requirements

- No obligation to make additional contributions, no debt risk

- Trade now free of charge on nextmarkets!

- Forex Demo Account

- Instant Visa & MasterCard deposits

No margin call, limited levers

The rightly discredited obligation to make additional contributions does not exist at nextmarkets. The fact that endangered positions are closed in good time means that you cannot get into debt, as was quite possible with some providers in the past. We want you to feel completely safe when trading. Under the guidance of the coaches, you can work on your own risk management and gradually implement your own strategies without endangering more than your invested capital.

The levers available to you are in line with the requirements of the European market supervisory authority, which have been limited to a maximum of 30:1 since August 2018 to protect investors. You can also trade without any leverage at all, and before you even use your own capital, you can test trading for an unlimited period of time with the free demo account. No one would accuse nextmarkets of fraud with these security measures.

Transparent fees and payment modalities

We at nextmarkets also attach great importance to transparency in other respects. There are no confusing account and cost models with us, because we want you to find your way around right away. As a nextmarkets customer, you therefore only pay the spread that applies when you place an order, and we are pleased to say that our spreads are considered favourable. You can view all spreads on the website, sorted by asset class. There are no other charges.

nextmarkets GmbH and its Maltese subsidiary do not charge any fees for processing deposits to the trading account, nor for withdrawals. Especially for the latter, it is not uncommon that minimum amounts are set for withdrawals or that the withdrawal is generally associated with fees. Also common are time limits that allow you a certain number of free withdrawals – anything above that is again subject to fees.

Your return is not affected!

With nextmarkets you are exempt from such restrictions. You can dispose of your credit balance and in your personal customer access you can always see what amounts you need for current positions. You are welcome to withdraw any free capital in excess of this amount on a daily basis. In this way we have ensured that your return is actually your profit and is not subsequently reduced by various fees.

All you need to do is check that your preferred payment service provider does not charge you a fee when you deposit or withdraw funds to your trading account. Since nextmarkets offers VISA and MasterCard as payment options, just like conventional bank transfers, you can choose a financial service provider that does this at no or low cost. The clear, straightforward cost structure is the real nextmarkets bonus. That is why we refrain from trying to convince you with discounts or promotions.

Free educational offers for the entry

You will not find promotions at nextmarkets GmbH and the Maltese company nextmarkets Trading, if only because we believe that our comprehensive range of products makes a bonus unnecessary. The offers of the nextmarkets School are one of the reasons for this. More than 15 hours of video material are available to inform you about the handling of the very intuitive stock exchange software, asset classes and strategies. The exclusive material complements the coaching of the financial experts.

- Videos and webinars for further education

- Coaching by 14 experts

- Intuitively operated software

In addition, we offer regular webinars where you can further deepen your knowledge. The concept of nextmarkets GmbH: A complete offer that turns brokerage, coaching and educational services into an integrated user experience. You can convince yourself of this without obligation with the nextmarkets demo account.

Unlimited and without obligation: The demo account

We attach great importance to the fact that you can really test all services and the associated conditions in peace. To this end, nextmarkets provides you with a demo account, without any time limit. To use the demo, you can register by entering an e-mail address and a password of your choice – nothing more is necessary. After just a few minutes you can trade with the completely free demo in a real trading environment, with risk-free virtual funds.

Furthermore, with the non-binding demo you can already access the analyses of the coaches and get your own impression of how the Curated Investment looks like at nextmarkets. You have as much time as you want – because you can use the practice account without any time restrictions, even if you have already set up a real money account.

Contact nextmarkets if you need us!

When you set up the demo account, you will find that we are not interested in your phone number! Therefore you will not receive any promotional calls from nextmarkets GmbH while using the demo. However, if you would like to contact us yourself, we are here for you. You can get in touch using our Contact Us form, located at the bottom of the page.

Alternatively, you can consult our detailed and in-depth FAQ guide, which offers answers to various questions for both new and existing customers.

Get to know us - with the Trading School on Malta

At nextmarkets, you have the opportunity to get to know the people behind the company in person in a live seminar at the nextmarkets Trading School in Malta. The first event in October 2018 was very successful and further events are planned. The live seminars offer content aimed at both beginners and advanced traders and combine exciting presentations by the coaches with a relaxing social program in St. Julian, Malta.

The contents of the lectures and workshops focus on strategies, risk management, stock market psychology and analysis. In addition to imparting knowledge, there will be the opportunity to see the offices of nextmarkets Trading Limited from the inside and to meet the management personally.

Conclusion: All facts on the table at nextmarkets

As a customer of nextmarkets GmbH and the affiliated company nextmarkets Trading Limited, you do not have to search for background information on your broker. nextmarkets is completely transparent with regard to the structure of the company. Already on the website you can find out what you want to know about the management and the coaches. There are no surprises in our costs and fees either, you can find out everything in advance. This also applies to the licensing and regulation of the brokerage services and the associated measures to secure customer deposits.

In this way, you don’t have to spend a lot of time dealing with your broker, but can start trading right away under the guidance of coaches – and all this without any risk with the unlimited demo account, which gives you the opportunity to see for yourself what nextmarkets has to offer. You can get in touch with us online – or perhaps you would like to be present at one of the next Trading School events in Malta?