Hedging strategies - start trading at nextmarkets

Hedging involves strategically using market instruments to offset the risks of any unexpected adverse movements in price. Professional traders use hedging strategies by “hedging” one investment and making another opposing investment to offset any potential losses.

While this might sound complex, with nextmarkets, you’ll gain insights from the experts to help you improve your trading strategy and enjoy healthy returns – all from a simple app on your smartphone. Hedging is an integral part of a trading strategy for traders who want to mitigate their risks.

The basics of hedging strategies

All investors should familiarise themselves with the concept of hedging if they wish to be successful. Ultimately, hedging is as much about protecting your portfolio as it is about increasing it. Both new and experienced traders can find themselves confused when it comes to understanding the basics of hedging strategies. Perhaps the simplest way to look at hedging is as a form of insurance.

When investors decide to hedge, they are essentially insuring themselves against potentially negative market events. While this doesn’t prevent said negative events from occurring, it can help reduce the impact they have on the investor’s portfolio.

What are hedging strategies useful for?

Brokers, portfolio managers, individual traders and corporations alike all find hedging strategies useful when it comes to reducing exposure to market risks. In fact, even non-traders use hedging strategies in real-world applications. Insurance is essentially a form of hedging, for example. Of course, hedging in the financial markets can be slightly more complex than paying an annual insurance premium.

In the world of investment, hedging is the definition given to the strategic use of instruments to offset the risk of unexpected price movements. In the simplest possible terms, investors hedge an investment by making another one with negative correlation to the original investment.

Is there a best hedging trading strategy?

It’s important to understand that no two days on the financial markets are alike. Things can get volatile quickly, which means there’s no hard-and-fast rule when it comes to hedging. It’s important to understand the risks that come with trading before jumping into hedging without a coherent understanding of how to best offset any potential losses.

nextmarkets trading platform is able to provide you with help, advice and tutorials from professional traders to explain in detail how and when to employ hedging strategies.

Hedging trading strategies UK that work

The simplest hedging trading strategies in the UK used by free CFD software and brokerages typically involve offsetting a loss in one investment with a gain in another. Let’s say for example that a trader owns shares in company X. While the investor believes in the future of company X in the long-term, they’re also a little apprehensive about short-term losses in the industry company X operates in.

To protect themselves, the investor decides to purchase a “put” option on company X – a right to sell shares in X at a specific price (known as the strike price). If the price of company X’s stock falls below the strike price, any losses will be offset by gains from the “put” option.

Fact Check

All you need to find out whether nextmarkets is right for you is an email address. You’ll receive a sum of virtual currency to try out the platform, and you’ll get access to all the insights available to our professional traders. Here’s just a handful of reasons to download the nextmarkets CFD trading app:

- Easy to use interface that facilitates quick trading from anywhere

- Advice and support from expert traders, including video content

- Zero commission and competitive spreads that allow you to keep more of your returns

The basics of trading

Before trying to get to grips with hedging strategies and other trading techniques, you should familiarise yourself with the basic terms and tenets of trading. While there are many rewards to be had from investing, there are considerable risks too, which is why it’s important to educate yourself. Don’t be afraid if you’re uncertain about something – it’s better to ask and learn than to leap in blindly and begin trading without the right knowledge. For example, it’s not uncommon for new traders to ask the following questions:

Learn hedging with virtual currency

To understand how hedging works, it’s important to get some practice in. Of course, this isn’t feasible if you’re a new trader who doesn’t want to risk losing capital before you’ve gained an understanding of the markets. This is where a demo account with free virtual funds comes in. With nextmarkets, you’ll benefit from a large sum of virtual currency to help hone your investing skills.

In addition to this, you’ll also receive help and advice from professional traders to help you develop your potential. When you’re comfortable with how hedging strategies work, you can then put your new skills into practice with real funds, and enjoy real returns.

Professional hedging strategies revealed

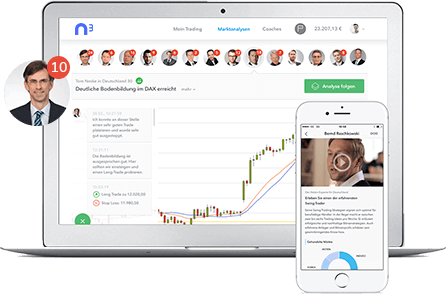

While it makes perfect sense to understand the theories behind hedging strategies, there’s no better way to learn than by observing how professional traders utilise hedging to their advantage. Some of the best trading platforms will even offer interactive content to help you better understand strategies with visual aids.

While hedging is ultimately about minimising losses, it can also be a useful tool to increase profits – particularly on the forex market. nextmarkets online trading platform helps you to understand the following techniques:

More simple hedging techniques

Another classic example of hedging involves looking at a company that depends on certain commodities to produce goods. Let’s imagine company X is worried about the price of commodity Y – a crucial ingredient involved in the manufacturing of their product.

Company X would be in trouble if the price of commodity Y was to leap up, causing their profits to plunge. To protect against the uncertainty of commodity Y, company X could enter a futures contract allowing them to purchase commodity Y at a specific future date, allowing them to budget without worrying about fluctuating commodity prices. The same principle can be applied to individual traders.

Automatic analysis

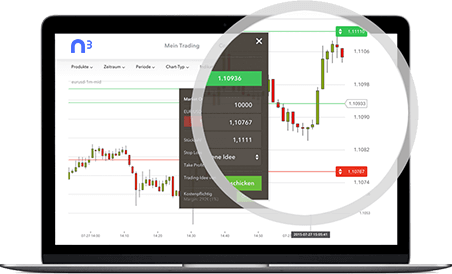

Hedging strategies are often reliant upon detailed technical analysis in order to make the right trading move. Automated analysis allows traders to predict how markets might perform by poring over historic market data.

While this might seem a complex step, the good news is that many apps designed to facilitate forex trading for beginners come equipped with easy to understand charts, graphs and tutorials to explain how the markets work. The nextmarkets app is invaluable when it comes to learning how to trade CFD.

What is the best hedging strategy?

Ultimately, there’s no hard-and-fast rule as to the best hedging strategies – if there were, the markets would be all too easy to predict. The best hedging strategy depends on market circumstances, your own personal circumstances and the risks you’re willing to take.

As a general rule, many professional traders stick to a “one per cent” rule – never invest more than one per cent of your portfolio on a trade. This includes hedging. It’s natural for traders to incur losses from time to time, and hedging strategies are designed to minimise losses first and foremost. It’s important to familiarise yourself with the concept of risk management at nextmarkets which is vital when it comes to understanding day trading for beginners.

A beginner’s guide to trading by nextmarkets

As a beginner, phrases like “hedging strategies” might seem daunting – but they don’t have to. Trading for beginners is made easy with nextmarkets. The beauty of nextmarkets is that it provides traders of all levels with access to curated investment opportunities, the chance to mirror the trades of the professionals, tutorials and chat monologues which helpfully explain the techniques of the experts.

It’s not just an opportunity to begin trading – it’s an opportunity to improve your strategy and enjoy healthy returns in the process. With zero commission and competitive spreads, it’s no wonder so many traders are making nextmarkets their app of choice.

Did you know?

At nextmarkets, we’re proud to put our customers first. It’s why we offer the latest cybersecurity measures to keep your data safe, and we protect your investments for complete peace of mind. We guarantee the following:

- The flexibility to deposit and withdraw however you want

- Financial backing from Peter Thiel, FinLab and other well-known industry names

- Deposit insurance of up to £100,000

If you’d like to know more, why not simply get in touch with the nextmarkets team? Alternatively, open a free demo account today and find out for yourself why we’re the UK’s #1 trading platform.

Utilising successful hedging trading strategies

Every hedge comes at a cost, and perhaps the most successful hedging trading strategies involve the trader asking themselves if the benefit justifies the expense. Remember, the sole aim of hedging is to protect against losses, not to make money. The cost of the hedge – be it the purchase price of an option or lost profits from ending up on the wrong side of a contract – is impossible to avoid.

Think of it as the price you pay for avoiding complete uncertainty. While hedging is an important technique to learn, it can often be better to rely on smarter analysis via a dedicated broking platform instead of consistently using hedging as a fail-safe.

Internal hedging techniques explained

Internal hedging techniques (methods within a business) are often cheaper and simpler to arrange than external methods (dealing with a third-party). Internal hedging methods should always be considered first in forex, although they aren’t always available to all businesses and investors. Internal hedging methods can involve:

- Doing nothing – this isn’t always feasible for low margin investors, however.

- Matching – if an investor has income in a foreign currency they can operate an account in that currency, matching two currencies against one another.

- Leading/lagging – a method of cashflow management where the investor seeks to pay/receive forex payments earlier or later dependent on expected FX rate movement.

Best hedging strategies ever for beginners

While the risks of investing can be precarious, they are an essential part of trading as the risk and the potential for return are linked. Ultimately, the best hedging technique an investor can have is to be armed with a basic knowledge of how hedging works, and how it is an insurance policy against bad decision-making or market downturns.

While it can be worthwhile for seasoned investors to take some time to learn the intricacies of derivatives, the basic principles of hedging are often enough to gain an advanced understanding of how the markets work – and this will always make for better trading with nextmarkets.

Most successful hedging techniques in forex

If you find yourself asking “what are hedging techniques?” here’s what you need to know. There are a number of forex hedging methods that allow investors to minimise any potential losses. To better understand how they work it is advisable to trade with a platform that offers professional advice from seasoned experts.

Some of the most successful hedging techniques in forex include:

- Direct hedging: when the investor places a trade which buys a currency pair while simultaneously placing a trade to sell the same pair. The net profit may be zero while both trades are open, but money can be made if you time things right and close at the optimum time.

- Multiple currency pairs: when the investor hedges against a currency by using two other currency pairs. For example, going long with USD/EUR and short EUR/CHF, thereby hedging their EUR exposure.

What hedging means to investors

The majority of investors will never get involved with complex derivatives contracts in their career. In fact, many buy-and-hold traders tend to avoid short-term fluctuation. For such investors, there is little need to get involved with hedging. However, hedging can be an invaluable tool for day traders, and as such, it is important to understand how it works.

From individual traders to multinational corporations, hedging strategies can help to protect against serious losses – so it pays to understand the technique, even if you have little need to ever implement it. To further your knowledge of hedging, choose nextmarkets trading platform that offers tutorials from the experts. Mirror the pros to develop your own technique.

Learn vital trading strategies with nextmarkets

Whether you’re entirely new to trading or you’d simply like to try a fresh approach, perhaps it’s time to find out why so many investors are turning to nextmarkets as their platform of choice. With up to 200 monthly curated investment opportunities, help, advice and tutorials that allow you to get to grips with the techniques needed to develop your strategy, it’s the ultimate trading platform. Why not get started with a free demo account today?

- Forex fibonacci trading strategy

- Best forex scalping strategy

- Forex trading strategy - Best forex strategy 2023

- Scalping Strategy

- Bollinger Bands Strategy

- Donchian Channel Strategy

- Momentum Trading Strategies

- Best swing trading strategy

- Trading Tips and Strategies

- Best Day Trading Strategy 2023

- Forex trading strategy for beginners

- CFD Trading Strategies